- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

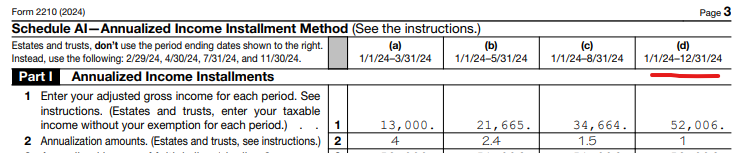

Use Form 2210 to determine the amount of underpaid estimated tax and resulting penalties as well as for requesting a waiver of the penalties.

At the screen Annualized Adjusted Gross Income, the dollars reported for the period of 1/1 to 12/31 will be added by the software and will equal the income reported on the Federal 1040 income tax return.

You are able to view the annualized income on page three of IRS form 2210 Underpayment of Estimated Tax.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 11, 2025

7:33 AM