- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Follow the steps below once you are signed into your TurboTax account.

- Click on Wages & Income in the menu panel > Search (upper right magnifier) > Type 1099r > Click the Jump to.. link

- Click Review beside the 1099-R you want to review

- Continue to the 1099-R details page > Check Box 1 and 2a and 2b (if there is a check in box 2b it will be important to answer the questions on the next pages

- Also Box 7 (the code is very important), then review the rest of your form > Continue

- Answer the question about whether this is an IRA, and what kind of retirement plan (usually Qualified)

- Answer whether any situations apply and Continue

- Answer whether you moved the money through a rollover..

- Next, any periodic payments > Continue

- Finally Preview My 1040 to check line 4 or 5 of the 1040.

I entered zero taxable amount, and did not select either check box for 2b. I selected 'None' for rollover. Please ask any other questions here that you might have.

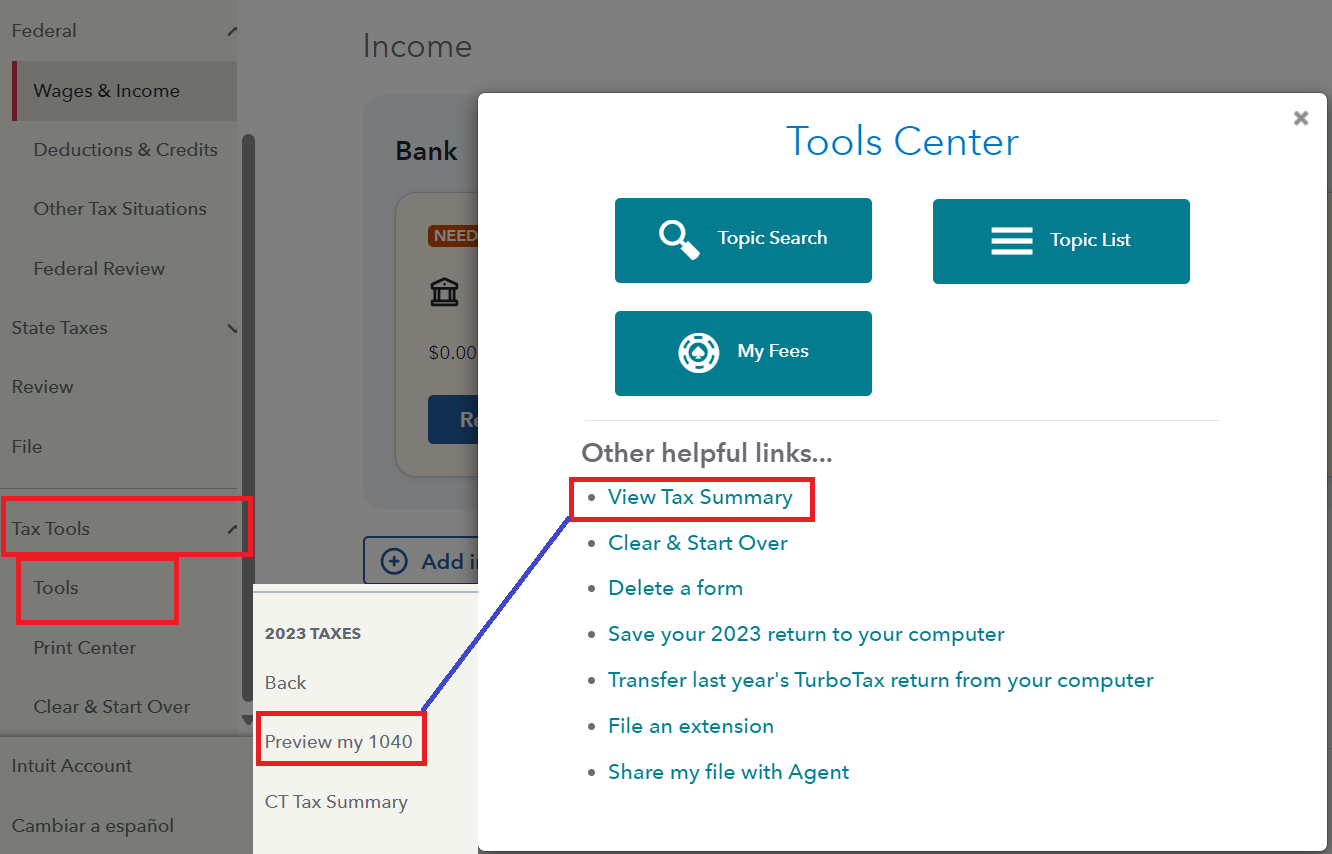

Using the Tax Tools to Preview My 1040:

- To find Tools:

- Sign into your TurboTax account and open or continue your return.

- Select Tax Tools in the left menu.

- You'll find Tools beneath Tax Tools.

- Select View Tax Summary

- Select Preview My 1040 (left black panel)

- See the image below

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 13, 2024

7:04 AM