- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

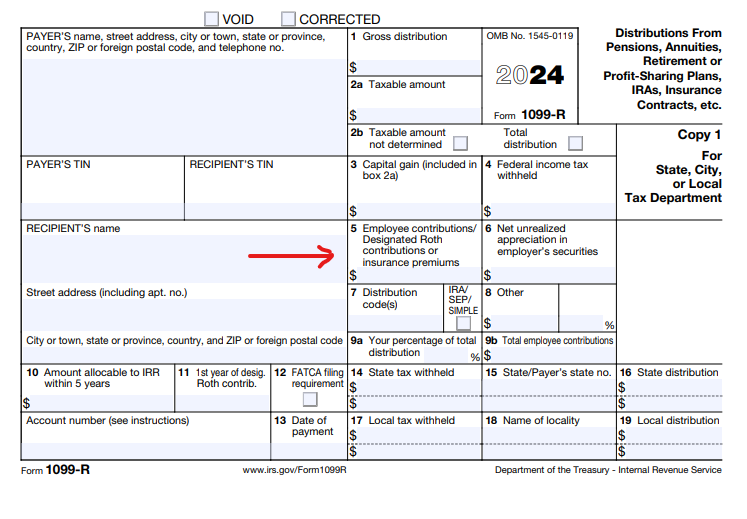

Box 5 of IRS form 1099-R Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans may report different employee payments.

Generally, for qualified plans, section 403(b) plans, and nonqualified commercial annuities, enter in box 5 the employee contributions or insurance premiums recovered tax free during the year based on the method you used to determine the taxable amount to be entered in box 2a.

IRS form 1099-R Instructions page 13 states:

Box 5 Employee Contributions/Designated Roth Contributions or Insurance Premiums

Enter the employee's contributions, designated Roth contributions, or insurance premiums that the employee may recover tax free this year (even if they exceed the box 1 amount).......

Generally, for qualified plans, section 403(b) plans, and nonqualified commercial annuities, enter in box 5 the employee contributions or insurance premiums recovered tax free during the year based on the method you used to determine the taxable amount to be entered in box 2a. On a separate Form 1099-R, include the portion of the employee's basis that has been distributed from a designated Roth account.

**Mark the post that answers your question by clicking on "Mark as Best Answer"