- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Form 1099-R, Box 12 - FATCA filing requirement is an optional field to complete. It is usually completed by foreign financial institutions, if required, or if a U.S. 1099-R payer is required to check this box due to foreign information reporting rules.

If this box is not checked on your copy and you imported it into TurboTax, it may help to delete this one and enter it manually.

To delete a damaged form, you can use Delete Forms

- In the left menu, select Tax Tools

- Select Tools

- Select Delete a form

- Scroll to the Form 1099-R and click Delete on the right

- Then scroll to the bottom and select Continue with my return

To re-enter the Form 1099-R:

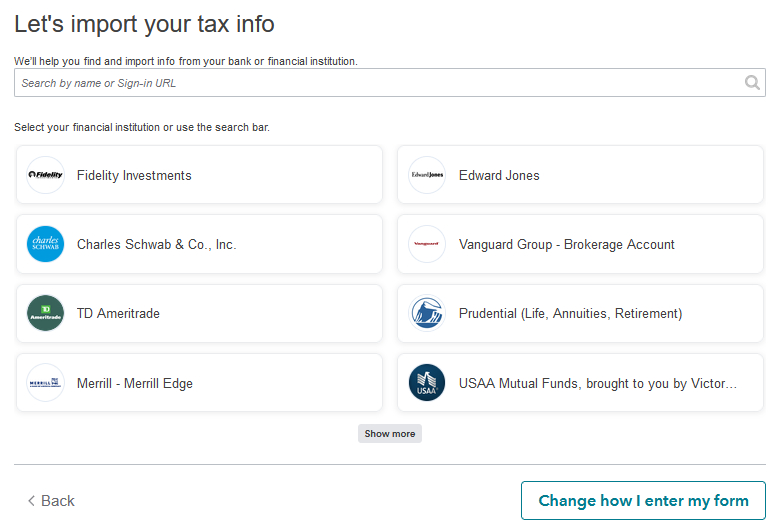

Click the Change how I enter my form button.

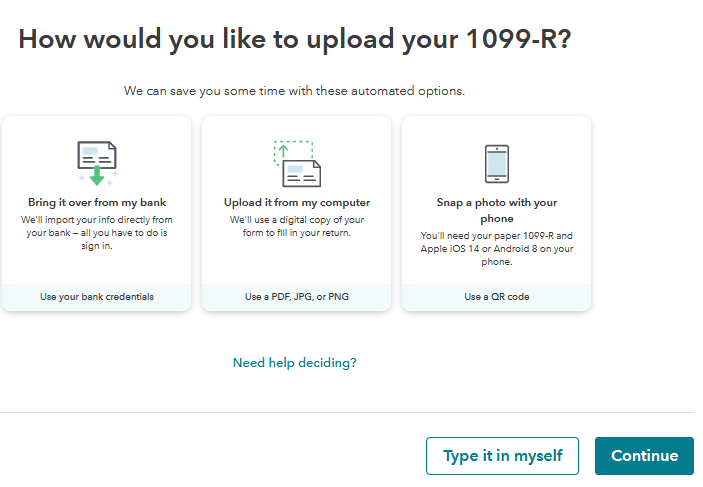

And select to scan and upload, take a picture with your phone, or the Type it in myself button.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 14, 2023

3:07 PM