- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

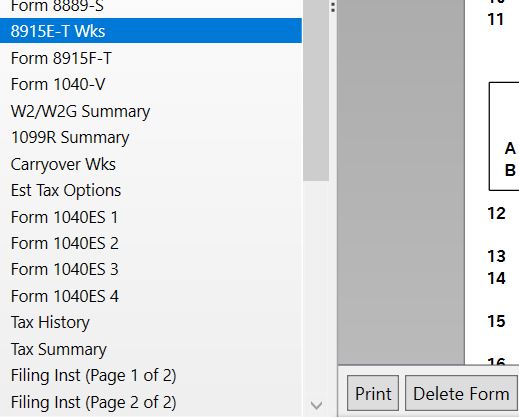

I reviewed your file. I couldn't find where the excess amount came from but I was able to solve it by deleting the 8915E-T worksheet in Forms mode and going back to the interview and renter the information:

- Click on the "Search" on the top and type “1099-R”

- Click on “Jump to 1099-R”

- Answer "No" to "Did you get a 1099-R in 2021?"

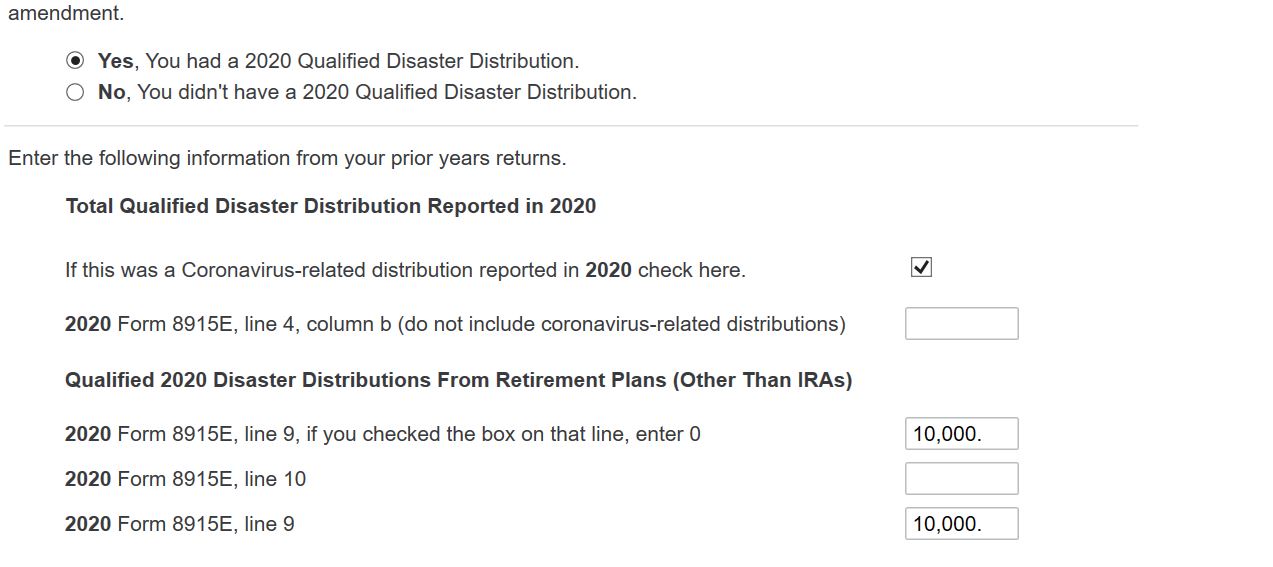

- Answer "Yes" to the "Have you ever taken a disaster distribution before 2021?" screen

- Check the box next to "If this was a Coronavirus-related distribution reported in 2020 check here".

- Leave the box under it blank.

- Enter the amount from Form 8915-E, line 9 twice ($10,000)

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2022

11:01 AM