- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@mpinne wrote:

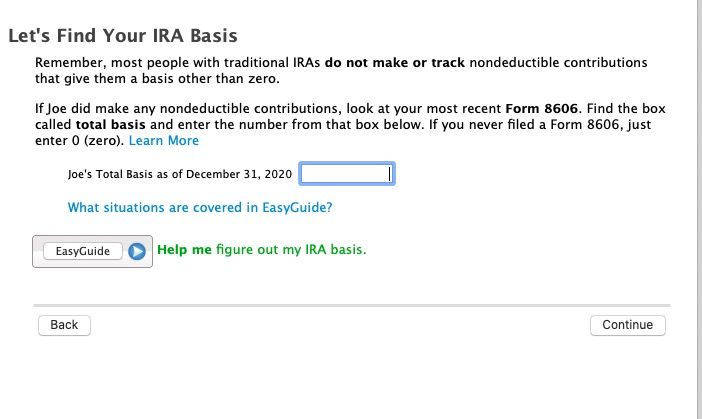

The 2020 Line 2 is wrong because it is $0 and doesn't reflect all prior contributions, and therefore Line 14 only reflects our 2020 contribution.

My second question is the fact that TurboTax created a "Explanation Statement" which includes my explanation for my 2020 being wrong. It separately created a "Blank Form" which includes an explanation for both my IRA (same as above) and an explanation for my wife's. It seems that these two explanations should be on the original explanation statement, but I'm not sure how they are created and therefore how to fix them and/or associate the "blank form" with the 8606.

If this in in the IRA contribution interview it asks for any prior year contributions. It only asks for an explanation statement if TurboTax has tracked contributions and you are changing the amount and then it only for the spouse that the contribution is for.