- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@dmertz - Thanks for the quick response

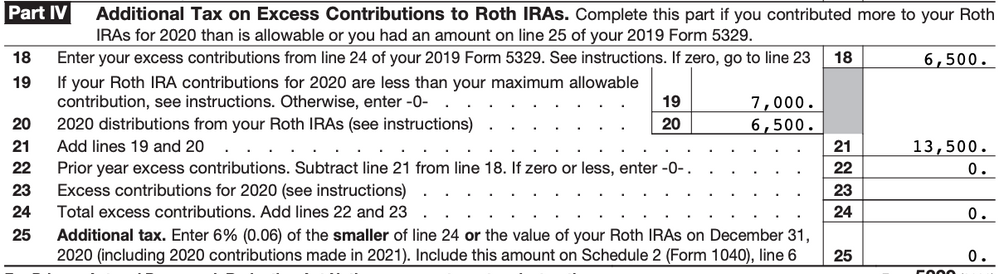

1. Before posting I did enter it in a 1099R but my mistake was not going through the entire process and answering the followup questions which is why it was taxing me. This is what I see now on Form 5329.

To answer your question in #2 above, I removed the 2020 excess contribution in anticipation (and calculations) that I would be ineligible, but that turned out to be incorrect. I believe that is also why I am seeing the $7000 on line 19.

Even though I am eligible to contribute, I think I am going to stay away from doing that this year just to stay away from any more complications in filing.

April 14, 2021

6:28 PM