- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@tmepfox :

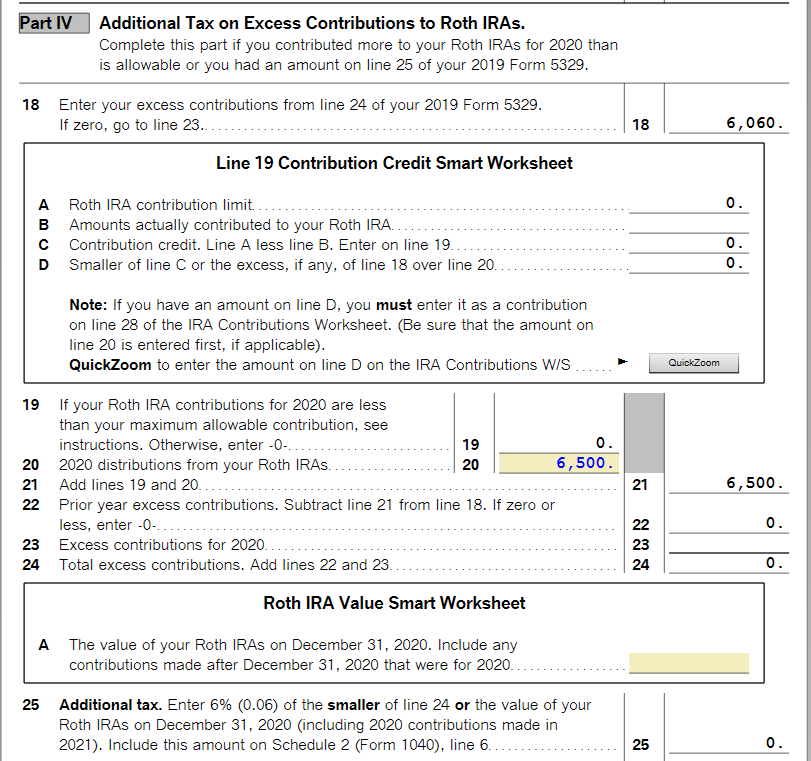

1. You simply enter the $6,500 code J Form 1099-R into 2020 TurboTax. In addition to including this distribution on line 19 of Form 8606, TurboTax will include this on line 20 of Form 5329 to be subtracted from the $6,060 shown on line 18.

2. 2020 Form 5329 Part IV. (I assume that you were not permitted any Roth IRA contribution for 2020, otherwise you would not have had any of your contribution for 2020 returned):

3. Only if the code JP 2020 Form 1099-R shows tax withholding do you need to enter it into 2020 TurboTax.

April 13, 2021

8:06 AM