- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

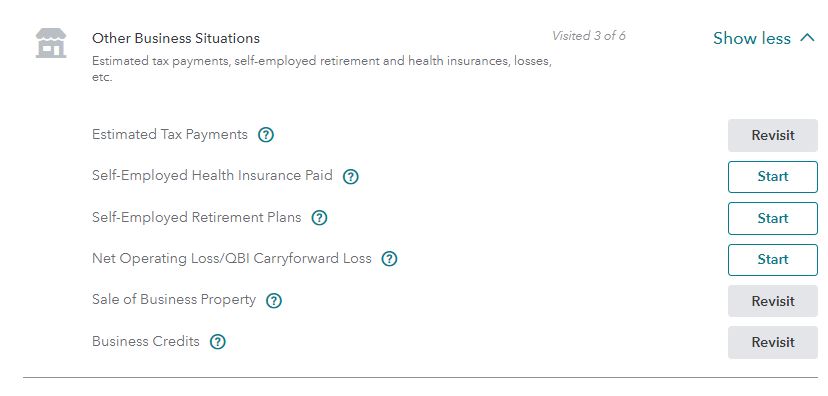

The entry for the SEP contribution is under Wages & Income- Other Business Situations (see below)

If you have self-employment income, you can contribute a certain amount of the profits from your business to special retirement accounts for you and your employees. Your contributions are tax deductible. The types of self-employed retirement plans are:

- Keogh

- SEP

- SIMPLE

- Individual 401(k)

- Roth 401(k)

TurboTax can help you figure the maximum amount you can contribute to your self-employed retirement plan.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 21, 2021

5:11 PM