- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew $59,406 from my Taxable Account as RMD in 2020. I put $29,406 back and converted $30,000 into a ROTH. How do I report this?

A total of $5,881 was withheld in taxes.

Topics:

March 13, 2021

1:21 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Incorrect Answer deleted

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 13, 2021

1:42 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

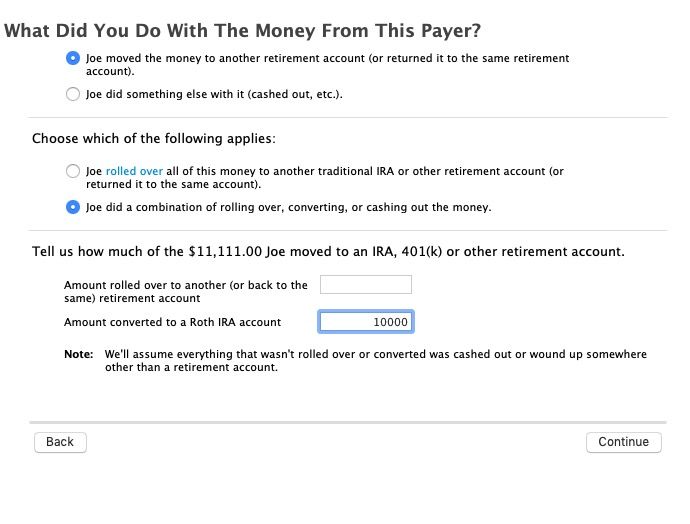

Unfortunately this is a situation TurboTax does not support on a single 1099-R.

You must split the 1099-R into two 1099-R's both the same except for the box 1 and 2a amounts and box 4.

On one enter only the amount rolled over in box 1 and 2a. Enter that 1099-R and say you "moved the money" and rolled it all over.

On the 2nd 1099-R enter the amount converted to the Roth in box 1 and 2a and the tax withheld in box 4. Enter that 1099-R and say you "moved the money" then say you did a contamination of things and enter the amount converted (The box 1 - box 4).

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

March 13, 2021

1:52 PM