- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Retirement

- :

- I withdrew $59,406 from my Taxable Account as RMD in 2020. I put $29,406 back and converted $30,000 into a ROTH. How do I report this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew $59,406 from my Taxable Account as RMD in 2020. I put $29,406 back and converted $30,000 into a ROTH. How do I report this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew $59,406 from my Taxable Account as RMD in 2020. I put $29,406 back and converted $30,000 into a ROTH. How do I report this?

Incorrect Answer deleted

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I withdrew $59,406 from my Taxable Account as RMD in 2020. I put $29,406 back and converted $30,000 into a ROTH. How do I report this?

Unfortunately this is a situation TurboTax does not support on a single 1099-R.

You must split the 1099-R into two 1099-R's both the same except for the box 1 and 2a amounts and box 4.

On one enter only the amount rolled over in box 1 and 2a. Enter that 1099-R and say you "moved the money" and rolled it all over.

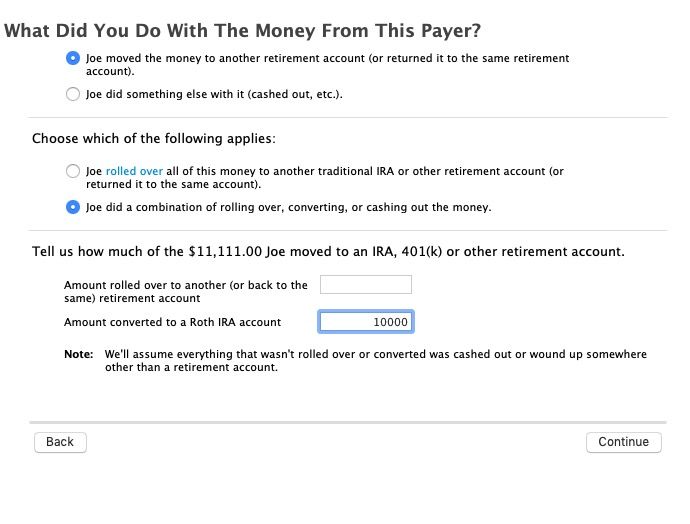

On the 2nd 1099-R enter the amount converted to the Roth in box 1 and 2a and the tax withheld in box 4. Enter that 1099-R and say you "moved the money" then say you did a contamination of things and enter the amount converted (The box 1 - box 4).

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

ArielA77

New Member

Andy_W

Level 1

BRB99

New Member

VAer

Level 4

valleybuy

Level 3