- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Delete the 1099R you are working on and re-enter. After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter Form 1099-R in the search box.

- You will see a Jump To function that will take you to the 1099-R input screens.

- Delete the 1099R in question by clicking on the trash can next to the form

- Then add a new 1099R and manually enter your 1099R.

At the financial services screens, click "Change how I enter my form" then "Type it myself"

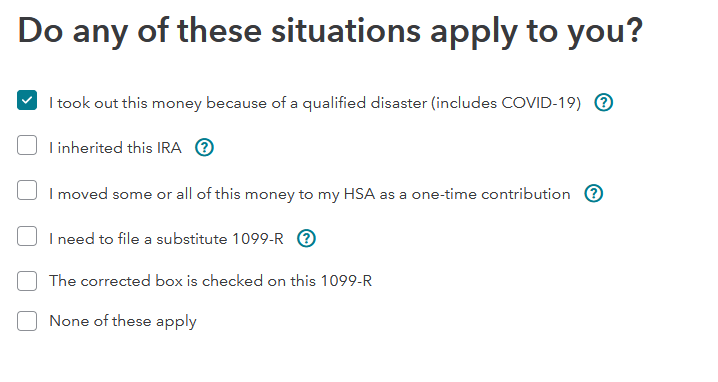

After entering the 1099R data and "Continue" you will see the screen to select the Covid-19 distribution option. Review your coding in box 7 of the1099R and TurboTax. It should be a 1,2, or 7 if its a traditional IRA. If its a Roth IRA distribution, temporarily change the coding. If its B1, then remove the B and continue. Once completed, edit the 1099R back to its original coding.

March 8, 2021

10:45 AM