- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

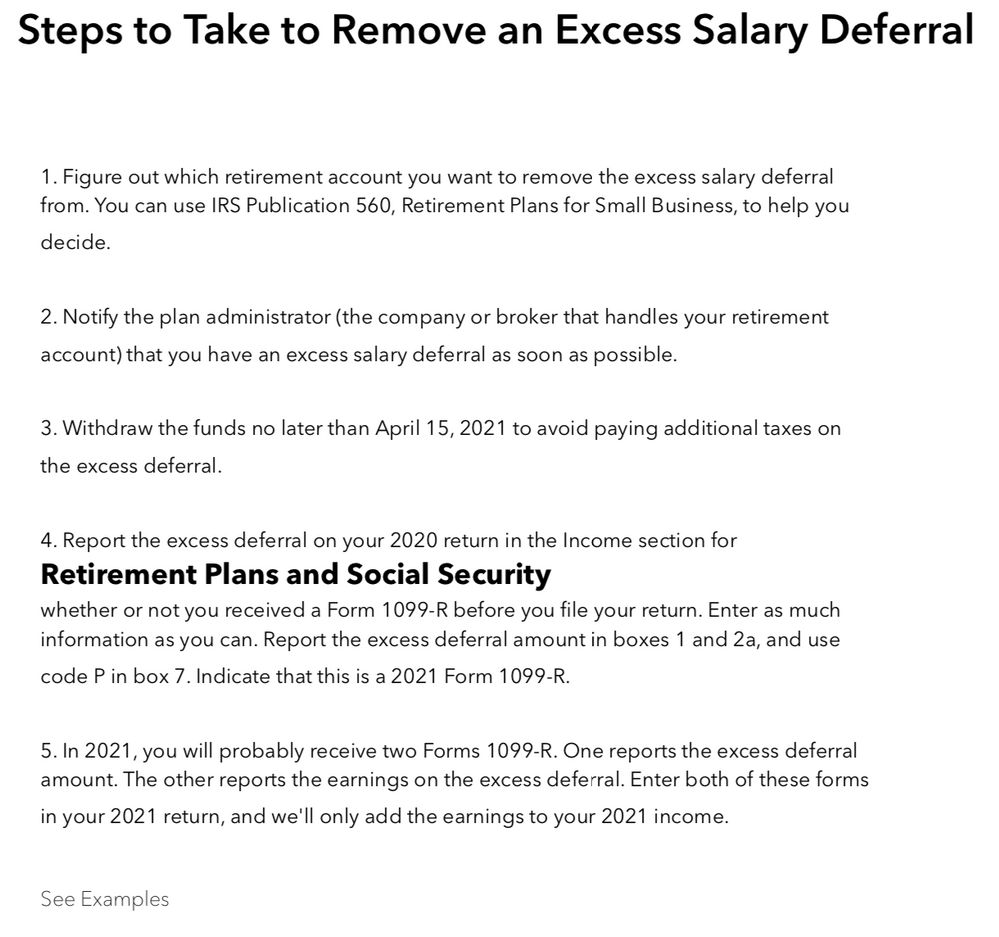

The advice provided above aligns with direction I found in the forum for prior years. However, the deferral was for 2020, not 2019 and the instructions TurboTax provided (see below screenshot) when I entered in my W-2s which reflected the excess deferrals indicates I should enter a 1099-R hence my confusion.

February 6, 2021

5:01 PM