- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

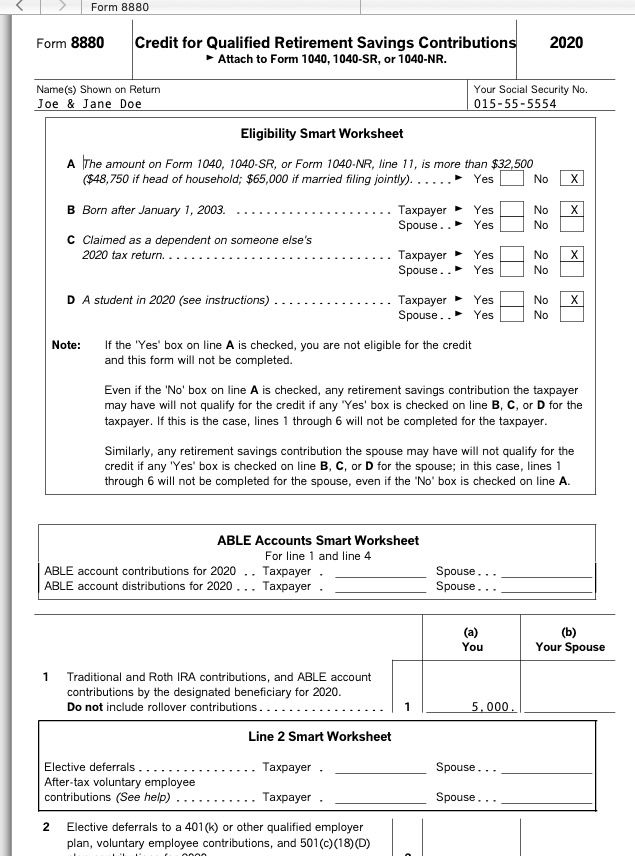

It works fine for me. If I enter $5,000 as a Roth contribution in the IRA contribution sections the the 8880 has it on line 1.

Check the 8880 form and the 1040 form line 15. Unless there is taxable income on line 15 there will be no savers credit.

**Disclaimer: This post is for discussion purposes only and is NOT tax advice. The author takes no responsibility for the accuracy of any information in this post.**

February 6, 2021

2:46 PM