- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

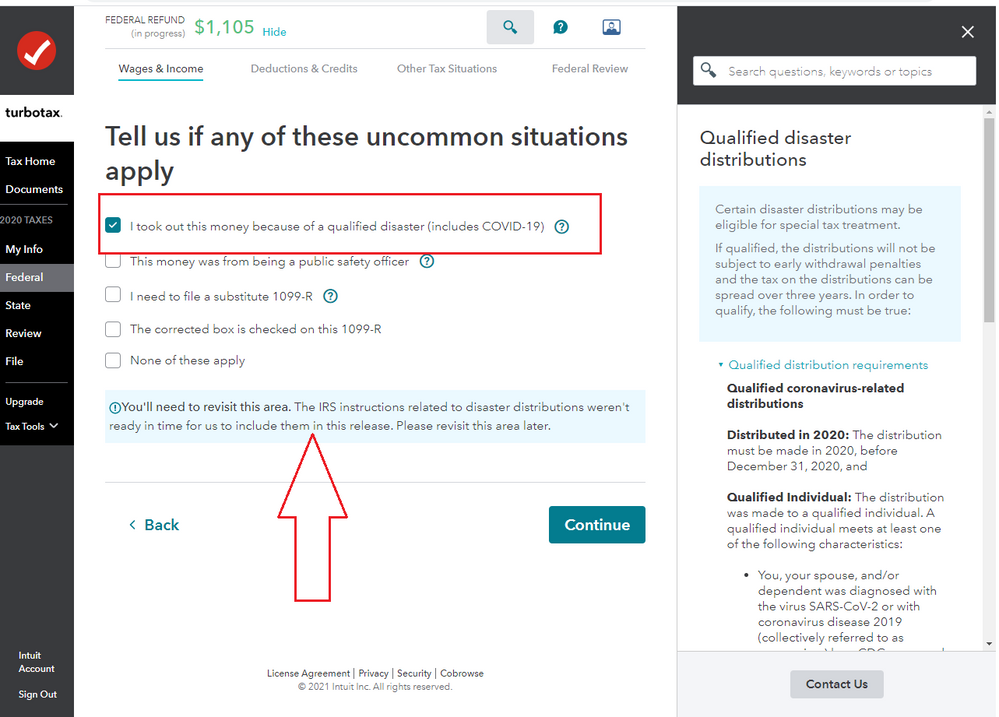

@bigrod7681 You won't be able to enter your COVID-19 related 1099-R just yet. You'll need to revisit this area. The IRS instructions related to disaster distributions weren't ready in time for us to include them in this release. Please revisit this area later.

- Type 1099-R in the search bar and select Jump to 1099-R.

- Continue with the onscreen interview until you get to the Tell us if any of these uncommon situations apply screen, scroll down to I took out the money because of a qualified disaster (includes COVID-19).

The 10% additional tax on early distributions does not apply to any coronavirus-related distribution.

Your 1099-R distribution is taxed over 2020, 2021, and 2022. You’ll have that time to pay back the funds you withdrew, without the amount impacting that year’s cap on contributions, and if you pay back the amount within that time, you’ll be able to claim a refund on those taxes.

Those who qualify as individuals directly impacted by the pandemic will be able to withdraw up to $100k from their retirement accounts without facing the 10% early withdrawal penalty.

You qualify if:

- You, your spouse, or your dependent are diagnosed with COVID-19

- You experience adverse financial consequences as a result of being quarantined, furloughed, or laid off

- You had work hours reduced to COVID-19

- You’re unable to work due to child care closure or hour reduction

As things change, TurboTax is continually updated and able to handle every situation that arises to ensure your taxes are done right, so you’ll receive your maximum refund.

[Edited 2/3/2021|1:12 pm PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"