- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Does the voluntary federal income tax withheld of $3980.40 on my SSA 1099 make the them question return, now the say I owe another $3981+326 interest?

plus $326 interes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

@BETTY-BOOP22 wrote:

on line 18 I reported $5841 but other report $1860 a difference of -$3981 which is a voluntary Federal income tax withheld thru social security. the cannot see this filing electronically. They now say I now owe $3981

plus $326 interes.

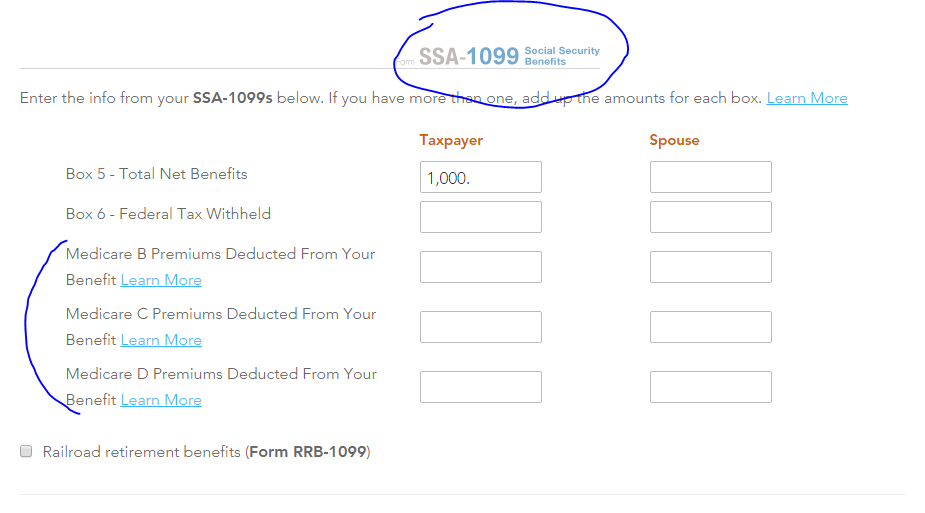

You put it on line 18 which is probably the problem because if must be reported on line 17. That comes form the "Tax Payments Worksheet" and Social Security paid comes from the "Social Security Benefits Worksheet" line B which comes form what yiu enter into the Social Security SSA-1099 interview Box 6.

If reported on the wrong line the IRS computer does not search elsewhere for it. If entered in the wrong location and the IRS computer cannot find any reason for "other tax payments" it will disallow it.

Call the IRS number on the letter you received and explain that you simply entered the tax withheld on the wrong line. They will tell you if you need to amend or not.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If you have withholding from the SS payments then when you enter the SSA1099 there is a box 6 for the withholding ... if you correctly enter it on that input screen it will go to the correct line of the return and you will never get an IRS letter in the future.