- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Hi thank you for responding. Your answer made the most sense. I am a retired school teacher in TX. The way it TX Teacher Retirement works is if you serve 30 years + your age and it ='s to 80 then you can retire. There is no penalty for early distribution. So the other two answers did not make sense to me. TX Teachers are not on a normal pension plan like other pensions. It's based on age and years of service.

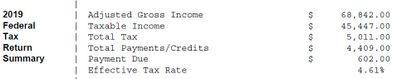

Part 2 is I do run a small business and it did say I owe $602 when I completed my business portion of my taxes. So that being all I owed, I was just gonna pay it and go on. (fyi; i am using turbo tax home and business and used if for the last 5-10 years).

Part 3 is when I put in my personal income from my 1099-R then it said I owed $5011 so that is where the extra amount owed came came from. But on the next screen it said based how you answered box 7 from your 1099-R, you don't have to pay any extra taxes. I answered in box 7 a #2. But the top of TT screen said I owed $50ll. So I freaked a little bec I didn't do anything different than what I did the last two years of retirement. And I got $3500 back in return. This year I owe the $602.

Part 4 so for grins I remembered the box said you don't pay any extra taxes on the amount so I completed my taxes to see what that meant and this is what I got. see the pic I included. Thanks for any help you can give me. Also are we paying a higher tax for 2019; because 2018 I paid 3.06% Thanks again!!