- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

Hi thank you for responding. Your answer made the most sense. I am a retired school teacher in TX. The way it works is if you serve 30 years and add your add with it and ='s to 80 then you can retire. There is no penalty for early distribution. So the other two answers did not make sense to me. Teachers are not on a normal pension plan like other pensions. It's based on age and years of service.

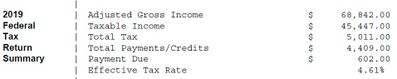

Part 2 is I do run a small business and it did say I owe $602. So that being all I owed, I was just gonna pay it and go on.

Part 3 is when I put in my personal income from my 1099-R then it said I owed $5011 so that is where the extra amount owed came from. But on the next screen it said based how you answered box 7, you don't have to pay any extra taxes. I answered in box 7 a #2. But the top of TT screen said I owed $50ll. So I freaked a little bec I didn't do anything different than what I did the last two years of retirement. And I got $3500 back in return. This year I owe the $602.

Part 4 so for grins I remembered the box said you don't pay any extra taxes on the amount so I completed my taxes to see what that meant and this is what I got. see the pic I included.Thanks for any help you can give me. Also are we paying a higher tax for 2019; because 2018 I paid 3.06% Thank you!!