- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

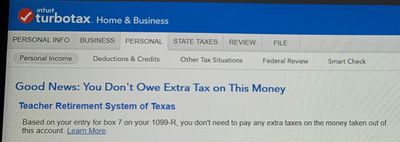

Well TT told me the way I answered box 7 I don't have to pay any extra taxes. See pic. For grins; I completed my taxes, analyzed them and it came up with total tax $5011 then total payments/credits of $4409. Then it told me I have tax rate of 4.61% and that is up from last year of 3.06%. (is the rise in the tax rate higher this year?). thank you for taking the time to answer all my questions.

October 17, 2020

11:46 AM