- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Retirement tax questions

If within 60 days then it was a rollover.

Be sure to answer the RMD question that some of it was a RMD and enter the amount as $20,000 or it will not allow a rollover of a RMD.

Enter a 1099-R here:

Federal Taxes,

Wages & Income

I’ll choose what I work on (if that screen comes up),

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version under My Account) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

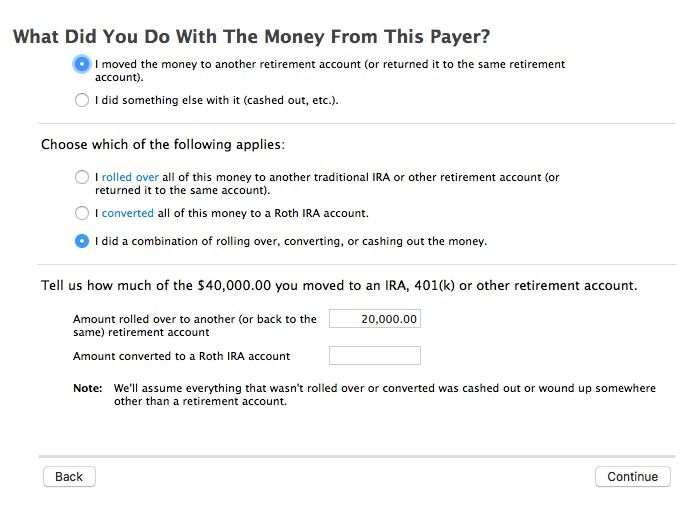

If this was a rollover answer the question that you moved the money to another retirement account (can be the same account). The screen will open up with choices of where it was moved. Say you did a combination of things. Enter the amount rolled over in the top box.

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

It will show as income on the summary screen which shows gross income, not taxable income.

The income will be reported on line 4a on the 1040 form with the word “ROLLOVER” next to it if it was a rollover.

The taxable amount will go on line 4b. In the case of a rollover, that amount will only the amount of the RMD.