- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

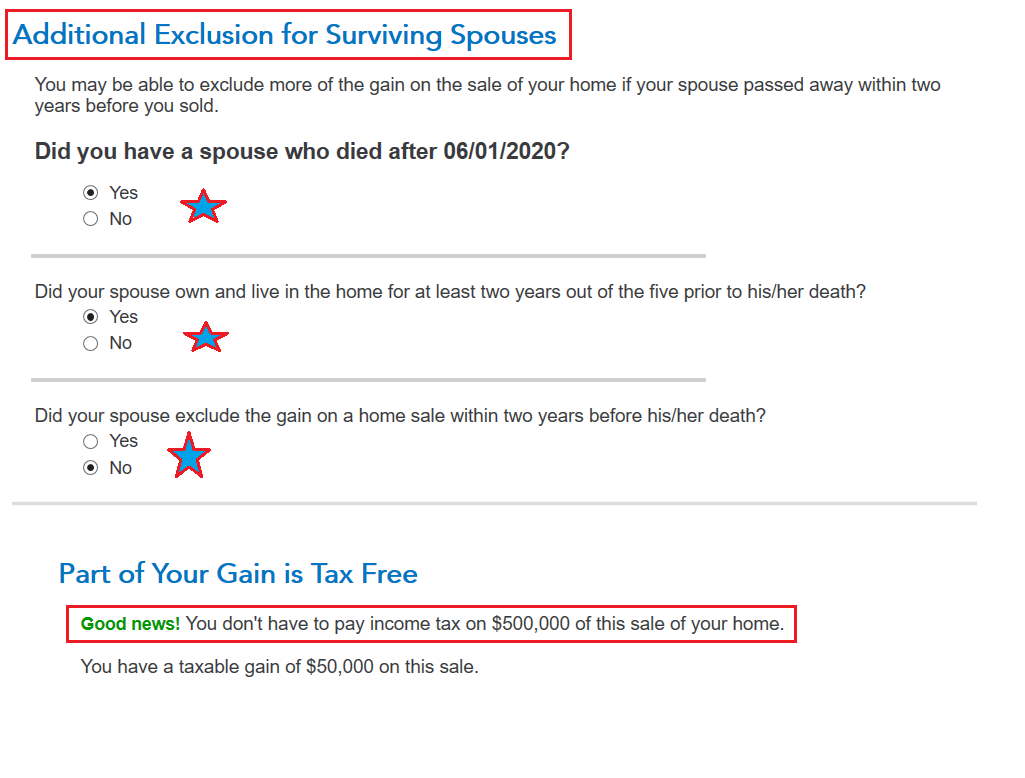

If you haven’t remarried at the time of the sale, then you may include any time when your late spouse owned and lived in the home, even if without you, to meet the ownership and residence requirements. Also, you may be able to increase your exclusion amount from $250,000 to $500,000.

You may take the higher exclusion if you meet all of the following conditions.

- You sell your home within 2 years of the death of your spouse;

- You haven’t remarried at the time of the sale;

- Neither you nor your late spouse took the exclusion on another home sold less than 2 years before the date of the current home sale; and

- You meet the 2-year ownership and residence requirements (including your late spouse's times of ownership and residence, if applicable).

- IRS Publication 523

If you sign into your TurboTax account > Search (upper right) > sale of home > Jump to... link > Continue to answer the questions and you will be asked about your situation.

- See the screen image below to see the questions about a deceased spouse.

In community property states – such as Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin – property acquired during marriage is the community property of both spouses. The property’s entire basis is stepped up when one spouse dies. In other words the fair market value on the date of death would be allowed as the cost basis and would likely show little to no gain when comparing it to the selling price.

Surviving spouse- Basis Example

If you are a surviving spouse and you owned your home jointly, your basis in the home will change. The new basis for the interest your spouse owned will be its fair market value on the date of death (or alternate valuation date). The basis in your interest will remain the same. Your new basis in the home is the total of these two amounts.

If you and your spouse owned the home either as tenants by the entirety or as joint tenants with right of survivorship, you will each be considered to have owned one-half of the home.

Example.

Your jointly owned home (owned as joint tenants with right of survivorship) had an adjusted basis of $50,000 on the date of your spouse's death, and the fair market value on that date was $100,000. Your new basis in the home is $75,000 ($25,000 for one-half of the adjusted basis plus $50,000 for one-half of the fair market value).

- For Community property states the stepped up basis would be the amount for the entire home.

If it has been more than two years after the spouse's death, or has remarried, the surviving spouse can exclude only $250,000 of capital gains.

@Nancjnsn

**Mark the post that answers your question by clicking on "Mark as Best Answer"