- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

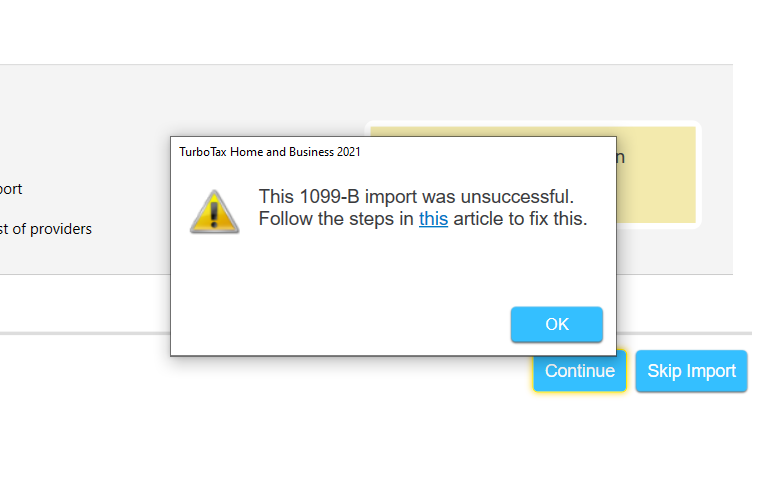

I have an issue connecting my TurboTax home and business desktop app to Schwab to import my 1099-b. i spent many hours on the phone with support to explain the issue and troubleshoot. Eventually, i got help with second tier support and a case opened to fix the issue. This week i received an email saying the issue has been fixed. But when I try to import the Schwab 1099-b I now get a new error : "This 1099-B import was unsuccessful. Follow the steps in this article to fix."

That article only says if you have more that 10,000 transactions, Turbo tax cannot import, but i checked and i have less that 10k transactions, so should be able to import the 1099-b.

The alternative offered to use the summary amounts is not feasible as it asks me to send my statement with individual transactions to the IRS and that is several hundred pages. How can get this fixed or get a refund of my turbo tax cost?

I had a similar issue last year and had to be on support for several hours, but eventually TurboTax had an update with a fix.

I have seen some suggestions to use Tax Act , as that program allows you to attach a pdf of the 1099-b and you don't have to mail the statements.

Does anyone know if Tax Act can import the current year tax form i have already completed with TurboTax so i don't have to reenter everything I already entered in TurboTax into Tax Act?

I have read that Tax Act can import tax returns from a pdf of the return. but i am not sure if tax act will import the current year tax return from a pdf.

Thank you