- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

This would be considered a casualty which is fraud. This is reported on Form 4684 and then deducted on your return.

- Instructions Form 4684: If Form 4797, Sales of Business Property, isn't otherwise required, enter the amount from this line on your Schedule 1 (Form 1040), line 4. Next to that line, enter “Form 4684.

First you must reduce the loss by any insurance reimbursement if applicable. Also reduce it for any products you did receive such as cabinets. Next, as you have already outlined you need to take all the steps necessary to try to recover your money. Keep all of those records with your tax return should you need them later.

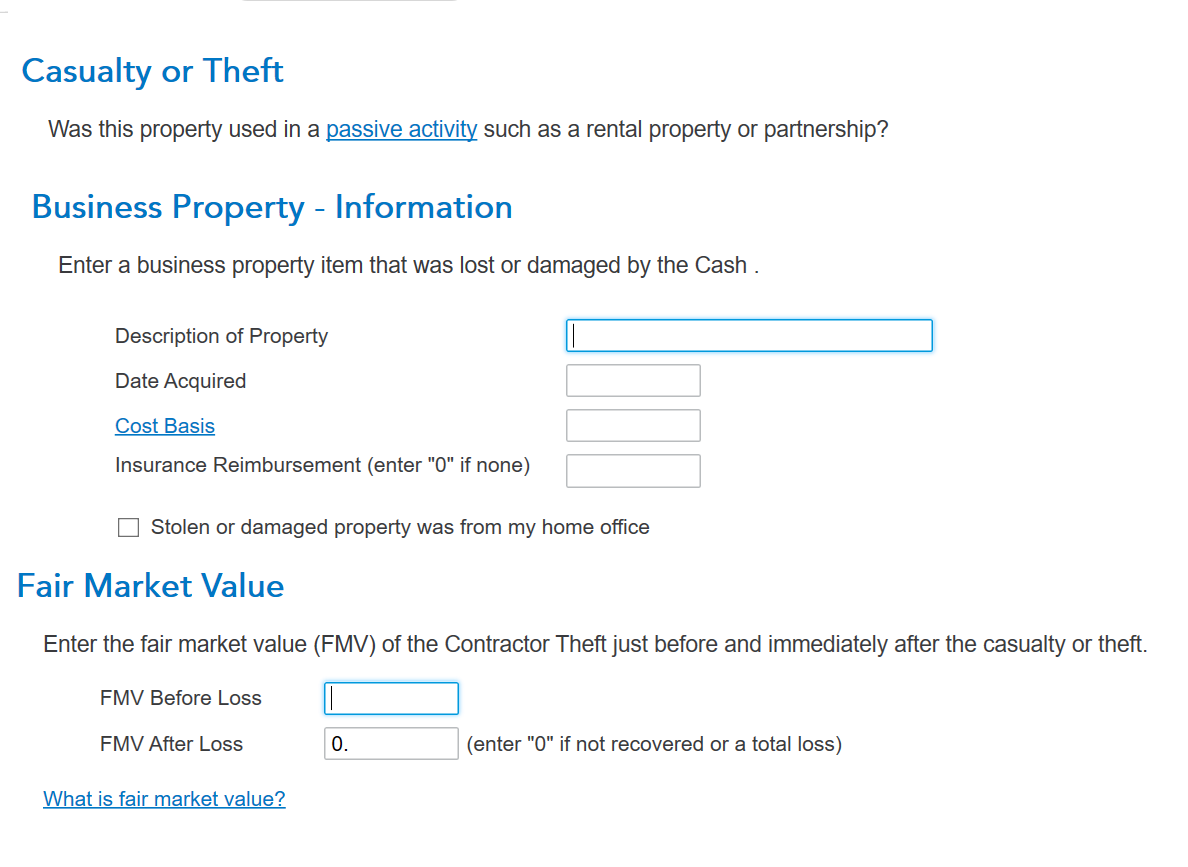

TurboTax will guide you through the process of reporting your loss. Be sure to select that it was an income producing property and that it was for a passive activity since it is for a rental. Below are some of the screen images you will see.

- Search (upper right) > casualty loss > click the Jump to ... Link > begin to enter your loss

If any money is recovered in the future it will be taxable income in the year you receive it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"