- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Generally, deductible closing costs are those for interest, certain mortgage points and deductible real estate taxes. Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction, including:

- Abstract fees

- Charges for installing utility services

- Legal fees

- Recording fees

- Surveys

- Transfer taxes

- Title insurance

- Any amounts the seller owes that you agree to pay (such as back taxes or interest, recording or mortgage fees, sales commissions and charges for improvements or repairs).

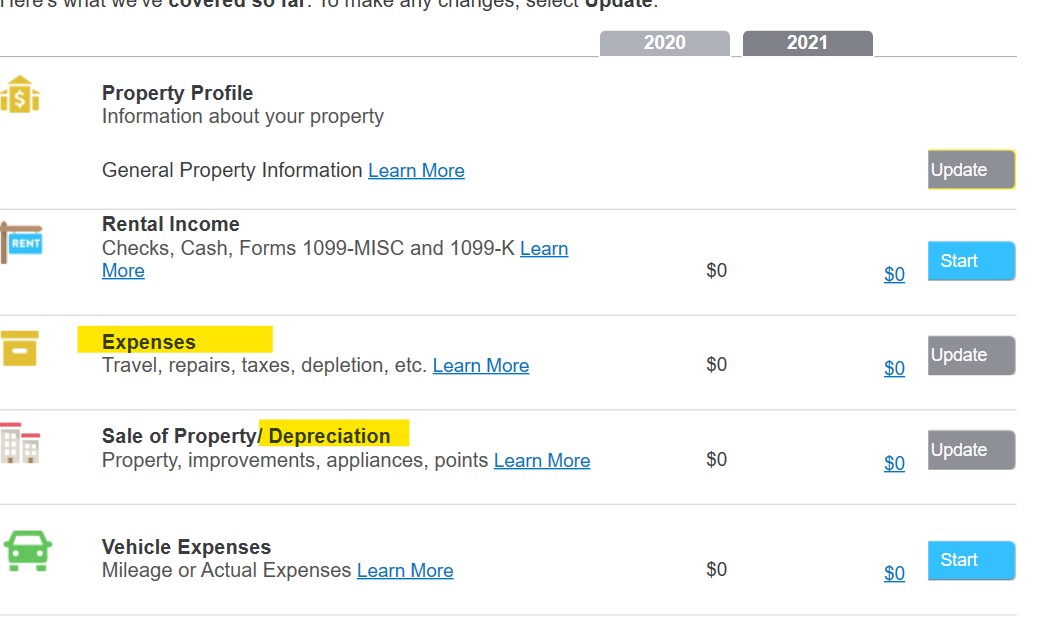

You enter these in the Assets/Depreciation (see image below) section of TurboTax. The condo management fee can be added to rental expenses. All of your income and expenses (and assets and depreciation) for the property go on Schedule E. This Help Article will assist getting the property entered and reporting any income and expenses for property.

Cost related to the acquisition of the loan are amortized and deducted over the life of the loan. An example of this would be your loan acquisition fee and if your lender required a survey as part of the loan approval process, the survey fee. These are entered in the Asset/Depreciation section as ''other assets'' and are amortized over the life of the loan

Cost related to acquisition of the property are added to the cost basis of the property. They get capitalized and depreciated over time (27.5 years). They are also entered in the Assets/Depreciation section. You will add them to the cost of the property when you enter the property as an asset in TurboTax.

Publication 527, Residential Rental Property (Including Rental of Vacation Homes)

**Mark the post that answers your question by clicking on "Mark as Best Answer"