- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Water heater replacement scenario (safe harbor minimum, bonus depreciation, or Section 179 options??)

I have owned a residential rental property since 2007, and I had a new water heater installed in April 2021. There is 0% personal use of the rental property. The pre-tax cost of the project was $2,632.66 (material & labor), so I do not think I can "1-year deduct" the cost under the Safe Harbor Minimum (limit $2,500). Please correct me if I am wrong.

Also, I do not think I can take a special 100% same-year bonus depreciation because the system is categorized under "plumbing" with a 27.5yr recovery period (limit 20yrs). Once again, please correct me if I am wrong.

I have reviewed Section 179 depreciation rules for tangible personal property used "to furnish lodging or in connection with the furnishing of lodging" based on the 2018 Tax Cut & Jobs Act expanded criteria. Can I treat the water heater as tangible personal property (not real property)? I am struggling to find IRS documentation stating I can not treat it as tangible personal property. Also, this linked article explicitly states water heaters are now included in Section 179 for residential landlords (www.firmofthefuture.com/content/higher-section-179-limits-and-enha[product key removed]ciation-in-ne.... The decision to use Section 179 would not create a loss for the business. If I cannot use Section 179 then are there other options for me to deduct this full cost in the first year of service? Depreciating a $2,633 project over 27.5 years seems inefficient.

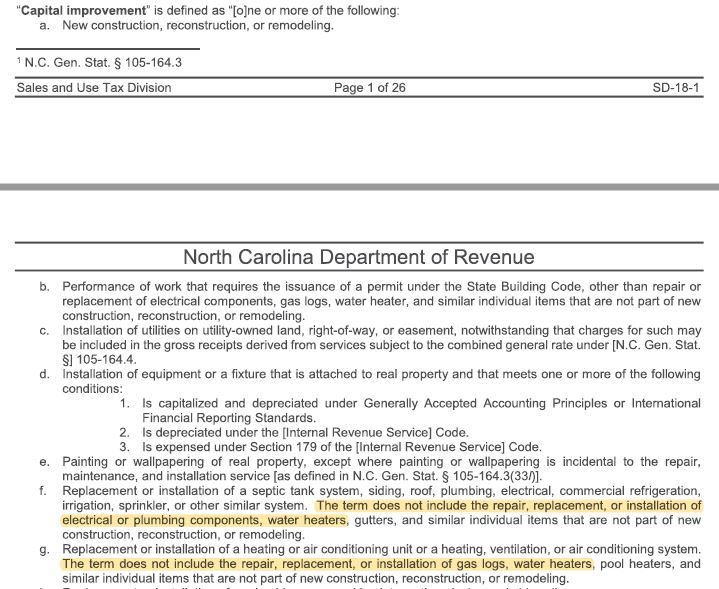

I even wonder if I should be capitalizing this project at all because the NC Department of Revenue does not categorize the replacement of a water heater as a capital improvement (see highlighted sections 'f' & 'g' below). This 'stretch-argument' would have me expense the project as repair/supplies.

Thank you for your time and your consideration of my question.