- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

You probably sold company stock and the ordinary income component of the sale is listed on your W-2 form, and that amount is not reflected on your form 1099-B.

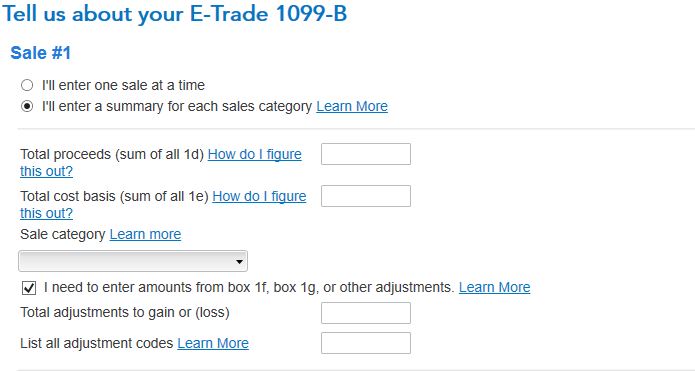

You should enter your 1099-B form in TurboTax, but adjust the gain to reflect the income reported on your W-2 form. You will see an option to adjust the gain on your form 1099-B when you enter the sales proceeds and cost as follows:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 30, 2021

4:47 PM