- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Rental Property: Do I have the original cost entered correctly?

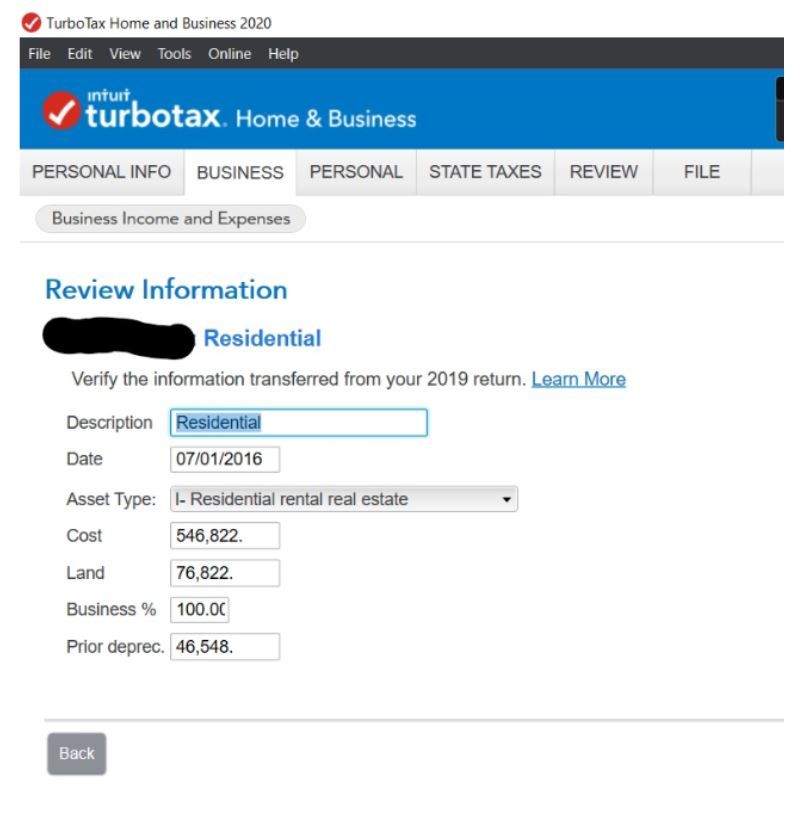

I'm wondering if I have my numbers correctly input. When entering the data for the sale of a rental property, in which I took a significant loss, it calculates a surprising capital gain. This is a home I purchased and lived in as my main home for 3 years, then rented it for 4 years. Please see the below screenshot for the following question: Should the "Cost" line reflect the total purchase price of the property, or the total purchase price less the FMV of the land?

The reason I'm asking is that I originally had it reflect the total purchase price less the price of the land, and sold it for a $71K loss (Sale Price - Total Purchase price - Costs of sale). When rolling the depreciation back in, it should still reflect a Capital LOSS of around $18K, instead Turbo Tax calculates a capital GAIN of nearly $50K.

When I changed it to what is reflected below, where now the "Cost" reflects the total purchase price of the home, and the "Land" is about 14% of that value, Turbo Tax then calculates and Capital Loss much closer to what I expected. I'm sure this must be the correct way of doing it, I would just feel much more comfortable about it if someone could verify this is correct.