- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business Percentage Use for Rental Property Rented mid-year

Hi,

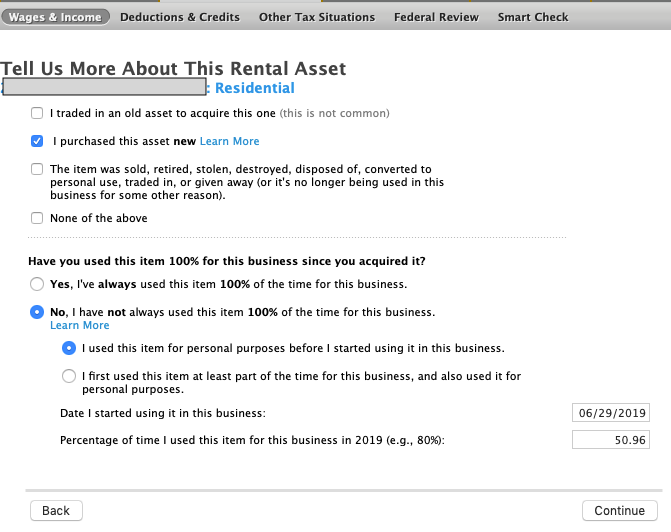

I would like help with determining "business percentage use" for my rental property that used to be my primary residence that I lived in. I bought it in August 2017, and I lived in it through June 28, 2019. I rented it out starting on June 29, 2019, which is 186 days that it was rented out last year. I am stuck on what to put on what the business percentage of use was on the screens, which I am seeing is connected to the depression sheets. Just FYI, from previous questions/comments/answers I've asked on here, I've been advised to do the calculation for mortgage interest, property taxes, HOA, home insurance, etc. Further meaning, I have personally calculated all these mentioned expenses by 50.96% (186 days rented in 2019/365 days in 2019 = 50.96%). So if I paid $10,000 in mortgage interest, I entered $5,096 for the rental portion then in my personal deductions area, I entered $4,904.

Please see screenshots below to help you visualize what I am asking for. Thank you in advance!