- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

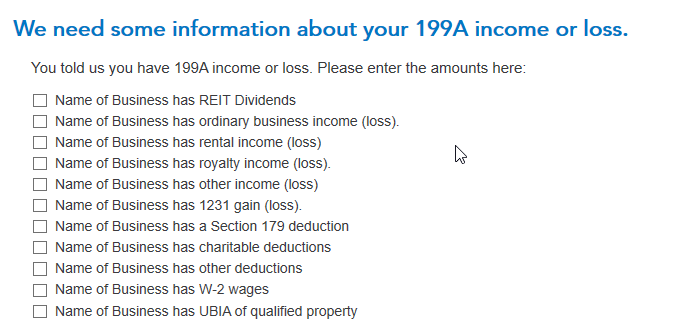

When Section 199A information is reported on a K-1, TurboTax requires an entry in one of the income boxes eligible for QBI treatment. For your K-1 (in addition to the "....QBIA of qualified property" line) check the box for "....rental income (loss)" and enter a zero in the box that "opens up". That should "clear" the error message you are getting.

@Matt3CPO

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

July 4, 2020

12:12 PM