- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Rental Asset

Hi. I have three questions.

1) if I put my townhome that I lived in on the market in April 2019, however, it did not rent until June, which date do I put as when the home was "placed into service"?

2) turbotax asks me during the deduction process what the rental business purpose is and gives options as "single family home" and "duplex or multi-family home" and other options. For this, would I elect the single family home option for my townhome?

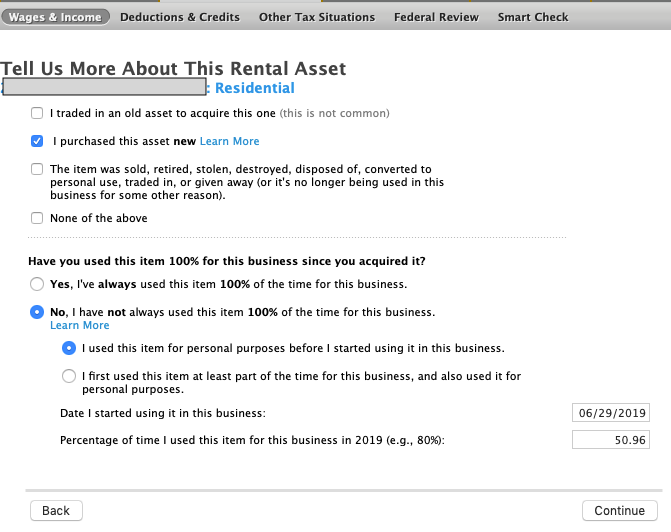

3) please see screenshot below directly from turbotax.

a. I purchased this townhome in 2017 new. Should I keep the box checked for "I purchased this asset new"?

b. because I purchased new in 2017 then rented it out in June 2019, I chose the "no, I have not always used this item 100% of the time for this business." When I choose this option, it gives two more sub options below it. I chose "I used this item for personal purposes before I started using it in this business". Are both these options I selected correct for my situation?

c. I used the date the rental period began as the "date I started using it in this business." However, I was unsure if I did the percentage part correctly for "percentage of time I used this item for this business in 2019". Should it be 50.96%? This percentage equates 186 days out of the 365 calendar year that it was rented out. Another similar question was asked in another section where the answer was 100%, so I am second guessing myself on this one.

Thank you in advance for your help! Greatly appreciate it.