- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

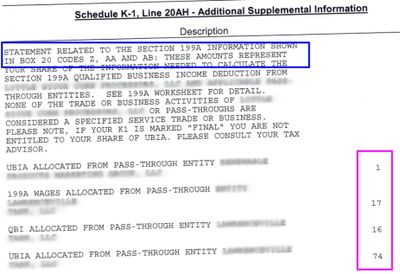

Thank you so much @DavidS127. The explanation and screen shots were extremely helpful to get me going in the right direction related how to enter information for code Z in Box 20. I did get a screen with boxes. However, I still have some confusion. Attached is an image of a portion of the statement with my K-1. The blurred out portions are just the name of the "business" to protect privacy in a way and because I don't think it's pertinent to my questions. However, showing the image here will hopefully help make my questions clearer.

question 1) noted in blue box - the description says it's for code AH but indicates information relates to codes Z, AA and AB. Box 20 of the K-1 itself has codes Z and AH noted to see statement; there is no code AA or AB in box 20 on my K-1. Could this be more of a "general" thing like in case I also had AA or AB? Or do I need to be looking for somewhere in TurboTax to enter information related to AA and AB?

question 2) noted in purple box - what are these numbers? TurboTax seemed to pull part of them in for code AH but not all of them. Do I add labels/descriptions in TT for the ones it didn't add. When I got to the boxes for code Z it pulled in 75 (from the 1 and 74 labeled UBIA). But the section 199A worksheeet I was entering numbers for code Z had an entirely different (higher) number for qualified property. Are the numbers labeled as 199A connected to code Z instead or as well?

Please let me know if you need further info or clarification on my question.

I'll be happy to scan and upload an image of additional info I have if it's needed.

Thank you so much for any help.