- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

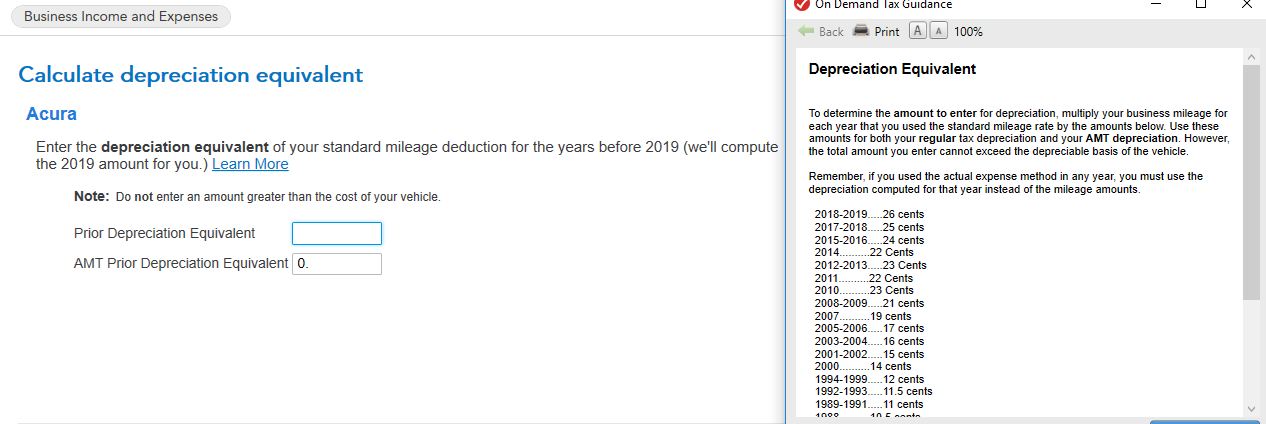

When you report the sale of the vehicle in TurboTax, you will be asked for the "depreciation equivalent", which is the depreciation portion of the standard vehicle deduction you take each year.

You will see this screen:

You calculate the depreciation equivalent by using the cents per mile allowed for the years you used the vehicle in your business, as listed in the table on the right.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 18, 2020

3:28 PM

2,023 Views