- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I ensure Turbotax includes depreciation for my rental property on my returns? I noticed in previous years this has not been included on schedule E.

Topics:

December 30, 2019

8:02 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

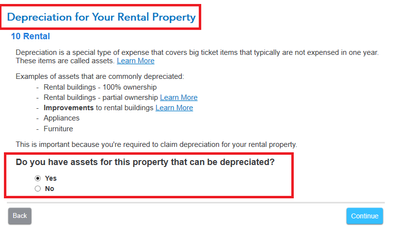

Did you set up your rental property in the Assets/Depreciation section under Rental Properties and Royalties? If so, the proper depreciation deduction should be calculated and carried forward to each successive tax year in TurboTax.

December 30, 2019

9:22 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Is their a section in rental portion of Turbo Tax to depreciate a rental property?

February 7, 2020

1:17 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

@zackofot wrote:

Is their a section in rental portion of Turbo Tax to depreciate a rental property?

You must enter the rental property as an Asset to be depreciated in the rentals section of the program.

February 7, 2020

1:21 PM

754 Views