- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

If you have a 1099-B from Robinhood, you can report them in the Investments and Savings section of TurboTax. This will create a Schedule D and 8949 on your return.

Here's how to import your 1099 from Robinhood into TurboTax Online:

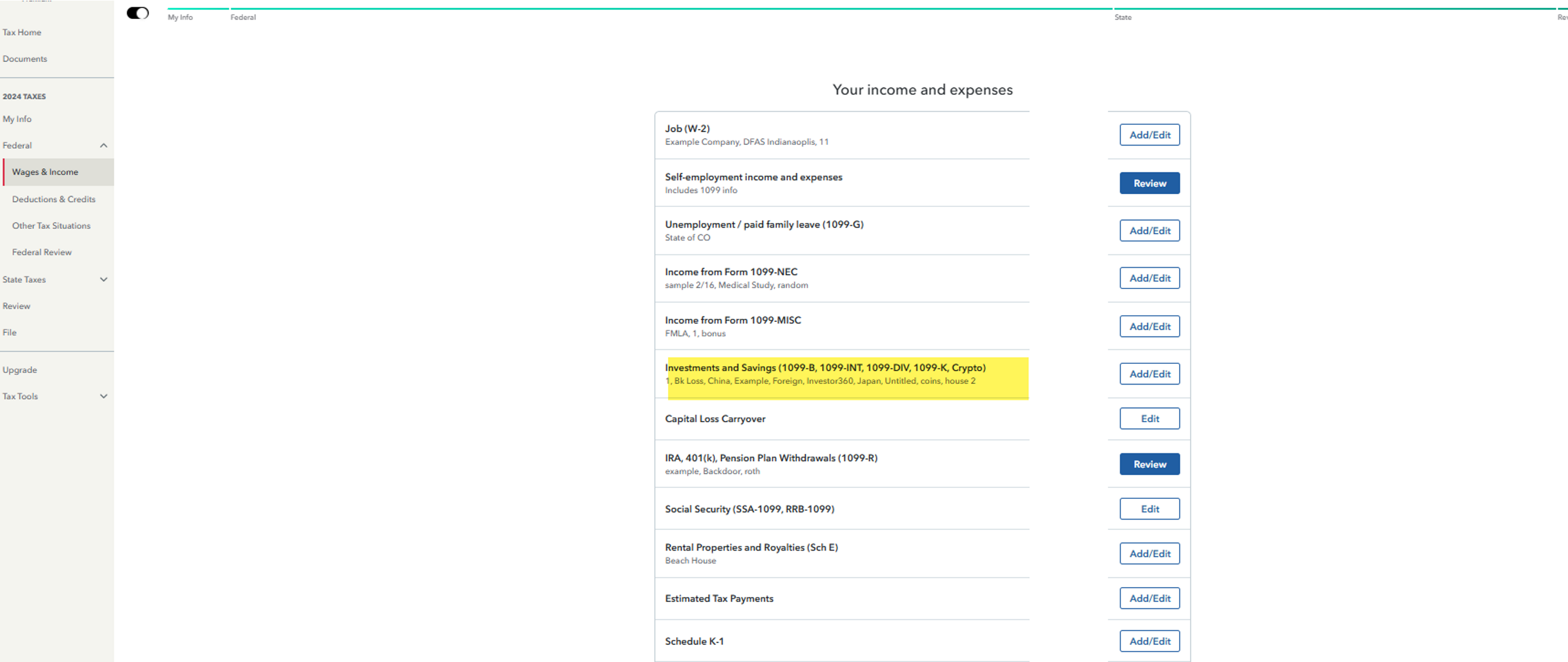

- Federal > Wages & Income

- Investment and Savings

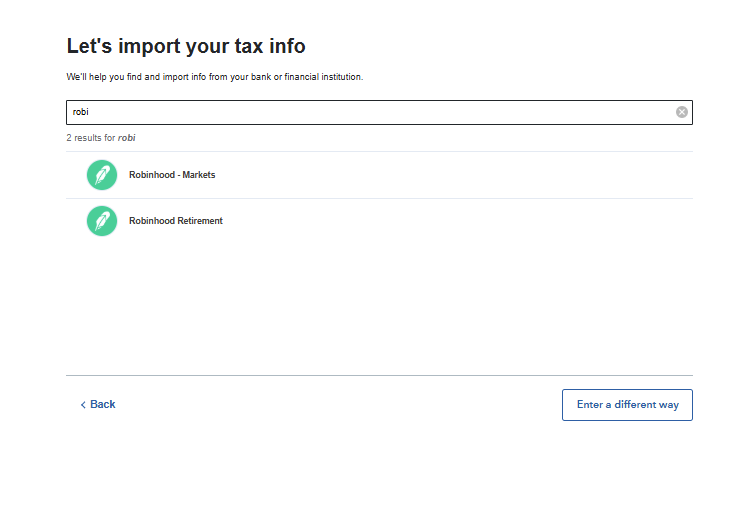

- Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B) > Start or Revisit

- Choose to add investments, and when you see Let's import your tax info, type "Robinhood" and continue through the interview to import

Here's some information you may find helpful: Answers to Common Questions from New Investors on Investor Apps, Accounts, and Tax Forms

March 31, 2025

6:18 AM