- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

It depends. When you enter the asset for the house the cost is the purchase price and purchase expenses. Once you have the total cost you can use the tax assessment to calculate the building portion of cost and land portion of cost.

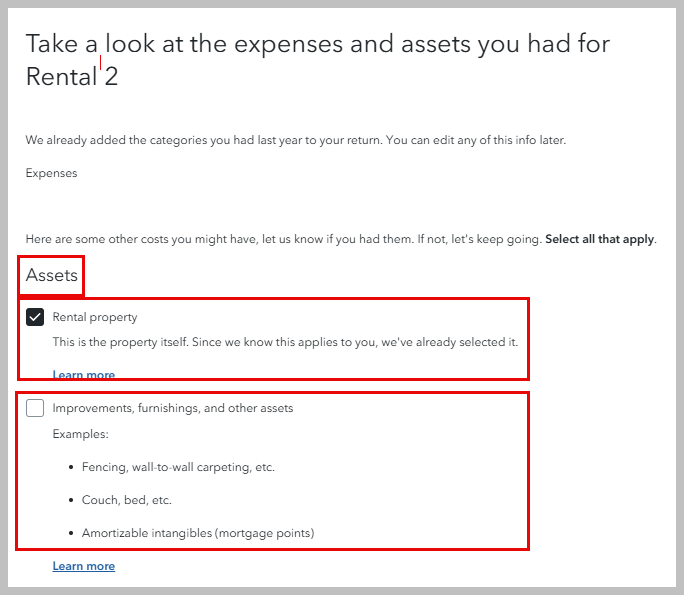

When you are in the rental section of your return you must add an asset. Select 'Residential Rental Property' then answer the questions about name, address, cost of house (enter the full amount) and the land cost (enter only the land portion) and date placed in service. TurboTax will calculate the correct depreciation. Even if the house was placed in service in December there will be a depreciation amount for a half a month.

See the image below. In TurboTax, search for rentals and select the Jump to link at the top of the search results.

- Follow the on-screen instructions as you proceed through the rental and royalties section.

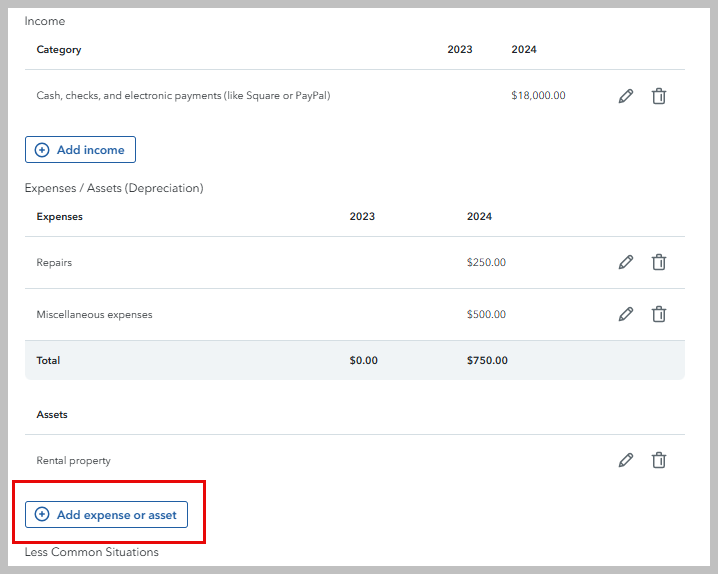

- On the Rental Summary screen, which is where you enter your rental income and expenses, Add expense or asset

- When you enter your rental house as an asset be sure to select Residential Rental Property, then follow the screen prompts to enter all the details

**Mark the post that answers your question by clicking on "Mark as Best Answer"