- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

$15,000 rental house renovation: one time expense ? or over years depreciation ?

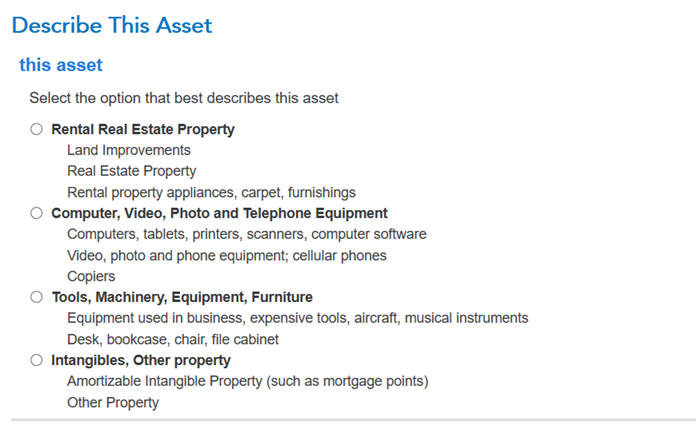

I spent $15,000 renovating my rental property in 2024 (LVP flooring installation, two bathroom renovations, hot water heater install, repiping the entire water pipes) after the previous tenant moved out (before finding a new tenant). Can I report the $15,000 as a one-time rental expense, or do I have to depreciate it over the years? If the latter, which category should I choose to depreciate this renovation?

Topics:

February 16, 2025

8:02 AM