- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report loss from K-1 for investment loss(invested Angellist startup shut down)

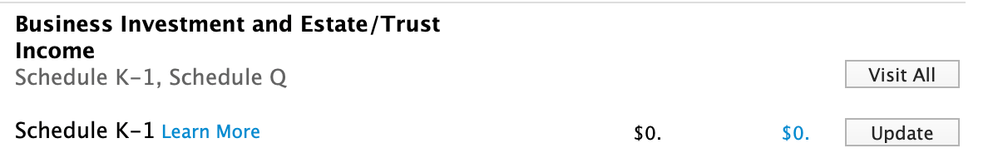

Hi, I invested a startup on Angellist in 2021 and the startup shut down in 2023. I received a final K-1, I filled it out on Turbotax, but the loss is not counted as in the screenshot. I chose "Disposition was not via a sale" and "All of my investment in this activity is at risk". Is it correct? Or I should add this investment loss to the Investment Income section? Thanks!

April 12, 2024

4:04 PM