- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors & landlords

Of course. The land can be added to the rental house or sold separately. If you do add it to the rental house, be sure to increase the total cost of the house by the land amount. TurboTax knows to remove the land before depreciating the property. The instructions for selling the land outside of the rental property can be done as follows:

- Wages & Income at the top

- Scroll down to Other Business Situations

- Select Sale of Business Property

- Select Sales of business or rental property that you haven't already reported.

- Answer 'Yes' to Do all of the following apply...?

- Enter your sales information, do not make an entry for depreciation (no zeros).

The following instruction should help you with the location to enter your carryover loss. You must go into the rental property income section first, then follow the steps to enter your carryover loss.

- Any passive activity loss (PAL) carryforwards allowed would be listed on your Form 8582, Worksheet 5 or 6, in your 2022 tax return as 'unallowed loss'. If you have a PAL and it does not seem to be populated in your 2023 tax return you can take the following steps to enter it.

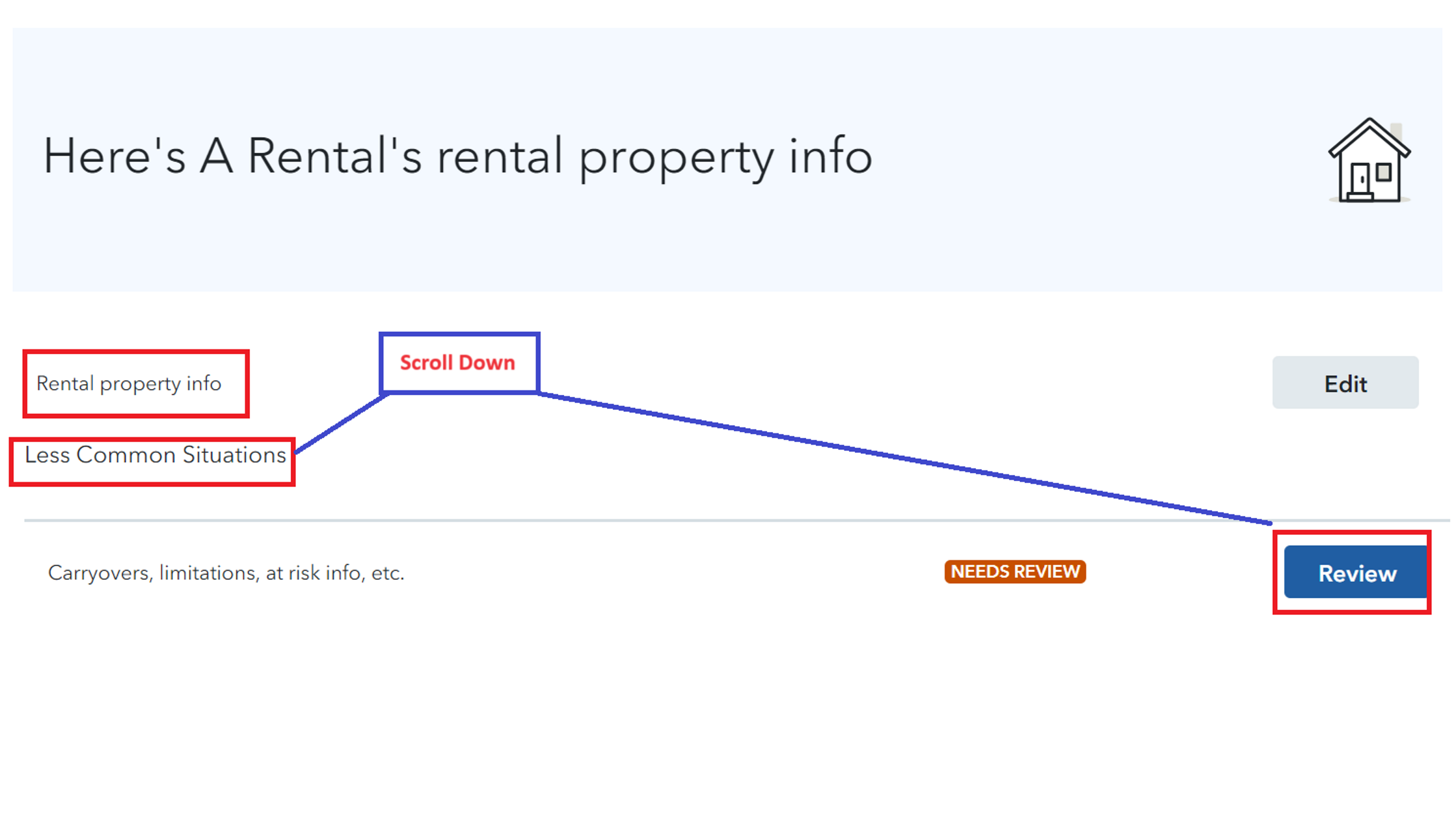

- Use the magnifying glass to Search (upper right) > Type rentals > Jump to Rentals > Select Edit beside your Rental Activity > Under Less Common Situations > Review Carryovers, limitations, at risk info, etc. > Continue to enter your passive loss carryover. See the image below for assistance.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 26, 2024

2:37 PM

1,754 Views