- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

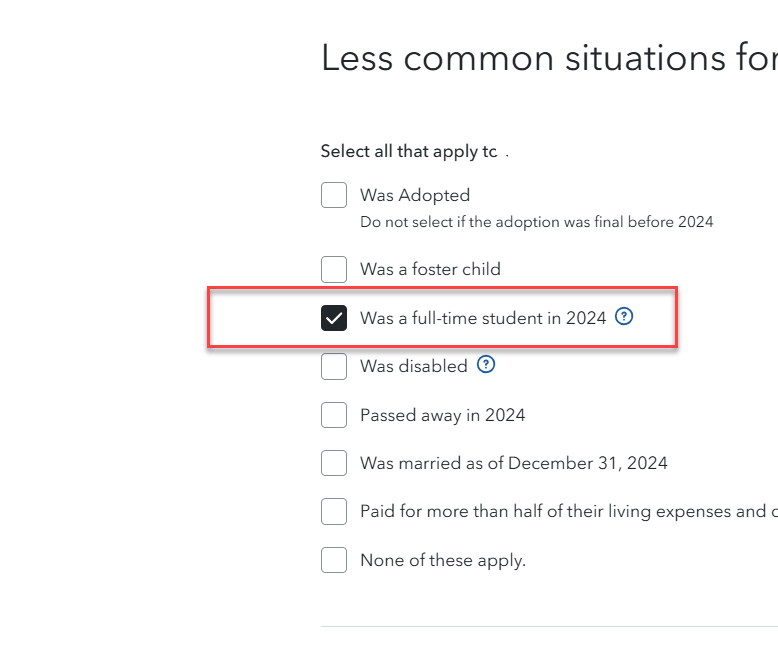

Yes, you can claim him and report the 1098-T, as long as he is under 24. Make sure you check the box that he was a full-time student in 2024 in the interview section . The definition of full time student is "5 months or more" so being a student through May qualifies.

Here are the rules for a qualifying child, from Rules for Claiming Dependents on Taxes:

- "Are they related to you? The child can be your son, daughter, stepchild, eligible foster child, brother, sister, half-brother, half-sister, stepbrother, stepsister, adopted child or an offspring of any of them.

- Do they meet the age requirement? Your child must be under age 19 or, if a full-time student, under age 24. There's no age limit if your child is permanently and totally disabled.

- Do they live with you? Your child must live with you for more than half the year, but several exceptions apply.

- Do you financially support them? Your child may have a job, but they cannot provide more than half of their own support."

March 30, 2025

2:15 PM

711 Views