- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

For anyone else having trouble with Education Credits in 2023 TurboTax Deluxe, I found an answer. I don't know the program's coding since most of us deal with a new version each year for only about a week. However, in the past few days, I've noticed weird stuff happening in different parts of the Education Credits section. Here are a couple of screenshots to illustrate.

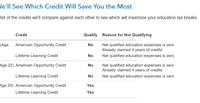

Clearly, it's impossible to answer a question when TurboTax has already selected both YES and NO.

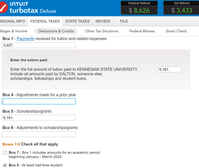

After saving my tax file to a flash drive, deleting TurboTax, and reinstalling it, it told me that 2 of our students had "Net qualified education expenses is zero," which is just wrong. It followed that by saying that all 3 of the 1098-T Box 5 scholarship amounts were "100% taxable income" and had to be included on each of our students' own tax returns. This completely disregarded all Box 1 amounts for each student.

SOLUTION

Again, I don't know TurboTax's internals. But I could delete worksheets or even entire student files, reenter their information, and get different refund amounts each time. I have no idea if this solution will work for anyone else, but it worked for me. First, I noticed that correcting our Box 1 amounts for the 1098-T forms reduced our Fed refund by $2,500 if I changed it to $1 over the $5,191 Box 5 amount for one of our students. I don't know why because he had already had 4 years of AOTC and didn't even qualify for it in 2023.

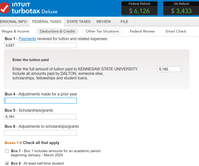

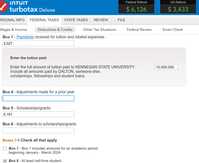

So, I started adding higher expenses paid to the school to see how much it would take to maybe raise our Fed refund. $10K, $20K, $50K didn't work so I unloaded with $10,000,000. I put in that amount for each of our 3 students and ran through the rest of the "Continue" clicks until TurboTax recalculated the education credits and BAM!, 2 students got LLC credits and the 3rd got his AOTC credit. I went back and changed the $10,000,000 amounts to actual qualified fees and expenses we paid, plus the Box 5 scholarship amounts and everything worked like it should.

Our particular problem was exacerbated by the University sending us 1098-Ts with Box 5 numbers larger than Box 1 numbers, so TurboTax was (correctly) trying to declare the excess scholarship amount as taxable income. If the 1098-Ts had been correctly processed for us, then the 2023 Box 1 numbers would have been larger than the Box 5 numbers.

So, the large $10,000,000 number did something. I don't know what, but it was like hitting "reset" for me because TurboTax was working normally again. YMMV. Good Luck!