- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can Someone Please Explain Why Entering The Actual Tuition/Expenses For 1098-T Can Reduce Fed Refund

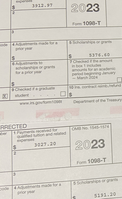

Our 1098-Ts are wrong.

The amounts in Box 5 are Zell Miller 100% tuition scholarships, paid in January and August directly from the state of Georgia to the school, and they are correct. I simply don't understand why the numbers in Box 1 are not AT LEAST equal to the numbers in Box 5. We had to pay additional fees/expenses for each student for each semester, so the Box 1 amounts should be well over Box 5. How does this still happen in 2023/24?

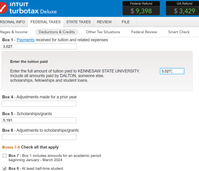

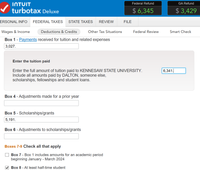

The really frustrating part is that when I try to correct the Box 1 amounts in Turbotax for one student and change them from the wrong $3,027 to the correct $6,345, our Fed Refund drops by $3,053!!! This is the first time I've felt like lying on my taxes because of the extreme punishment just for trying to correct the wrong numbers distributed by the school.

It appears to me that the Box 5 surplus over the reported Box 1 amounts is being taxed as income and providing a much larger refund than the true and accurate Box 1 numbers provide. However, if I simply DELETE all 1098-T worksheets and run the final checks before filing, TurboTax doesn't find any errors or say "you're missing 1098-T worksheets" or anything like that. And that results in the highest refund.

Obviously, I want to file legal and correct tax returns. But I'm really lost here and my head is hurting. Can someone please make some sense out of this mess? I would LOVE to wrap this up and file today and the Education Credits are the only thing preventing me from doing that.