- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Choosing a larger education credit" keeps lowering my AOTC credit and refund amount

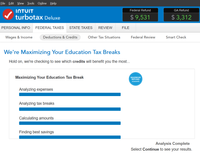

Is there a glitch in the "Choosing a larger education credit" area? Everything is perfect before I get to that page:

Then I get there and it says "you've already told us you want to treat $7,399 as a taxable distribution eligible for an education credit." WHAT?!?! I have no idea where this came from. I was never asked about taking non-taxable 529 Plan distributions and making them taxable...Until this page where it says I told TurboTax that I wanted that to happen. So then I hit continue to get out of this and it starts taking away from the $2,500 AOTC credit and reducing the Fed refund! I hit "back" and put in a random number and the refund goes down. I hit continue again and the refund goes down more.

So I deleted all 3 of the 1098-T pages, exited and saved. Then I keyed each 1098-T in again and everything was back to where it originally was with the first 2 screenshots above. Then I hit this stupid "Choosing" page again and just hit continue and it does exactly the same thing! The AOTC starts going down and the Fed refund goes down the same amount as last time.

I thought I would be finished with this tonight, and I should be. I don't understand what happened and why TurboTax thinks I want to be taxed on non-taxable distributions. Is there a way to just bypass this page altogether so I don't have to deal with it?

Or is there something else going on here that I need to correct before filing? Thank you for any help.