- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

For you to enter room and board as a qualified education expense that was paid for with a 529 plan distribution, you must first enter the 1099-Q for the student.

To enter the 1099-Q in TurboTax Online:

- Launch TurboTax

- In the search box type: 1099-Q and select the Jump to 1099-Q

- Follow the screens to enter your information.

Once you enter the 1099-Q, you will go back and edit the education expenses for the student.

To enter the education expenses:

- Type education expenses in the Search Box and select Jump to education expenses

- Select Edit by the student’s name

- Select Edit by Other Education Expenses (for all schools)

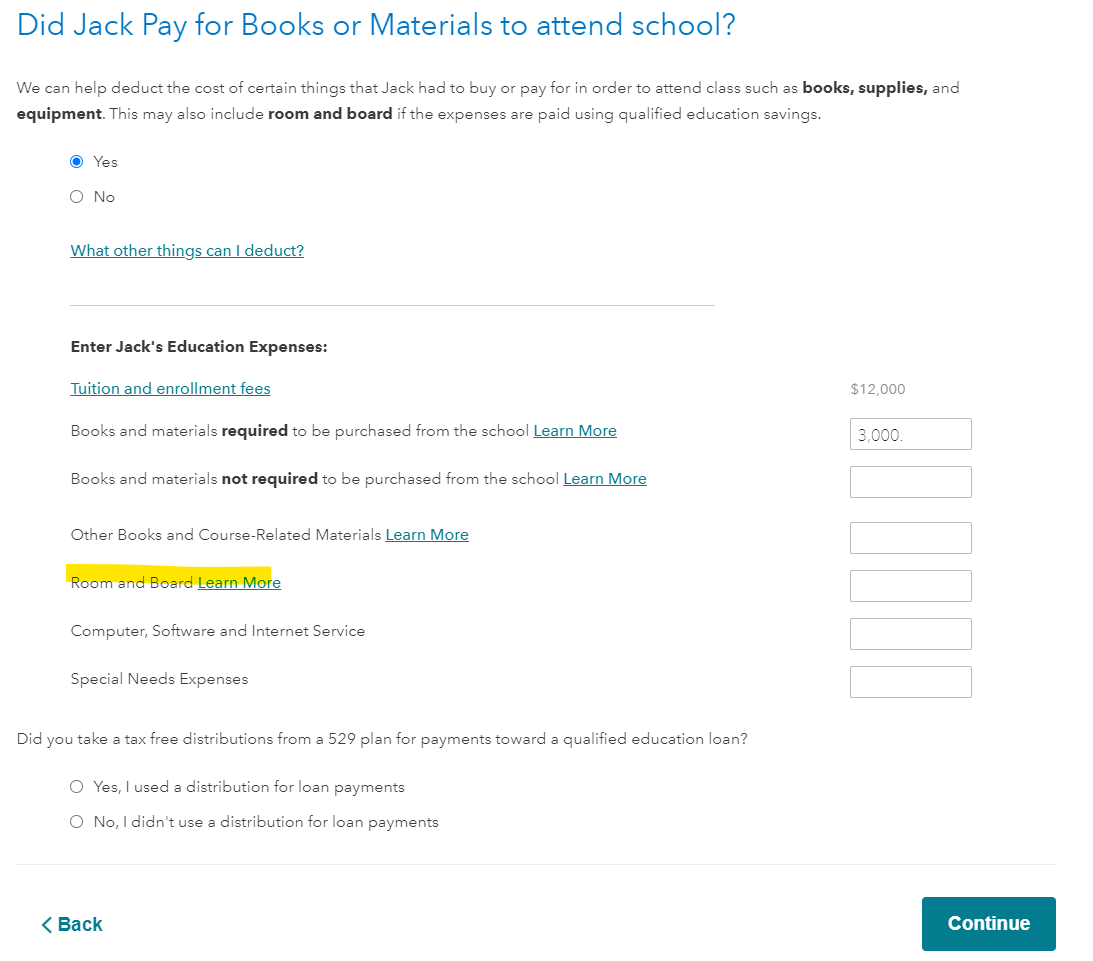

- You should see the screen below which is where you enter the room and board:

Please note, the 529 Plan withdrawal only needs to be reported on the tax return of the person whose SSN is on the form if the withdrawal is more than the tuition paid in Box 1 of the 1098-T and other adjusted qualified educational expenses.

Please review the TurboTax article Guide to IRS Form 1099-Q: Payments from Qualified Education Programs for further details.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 1, 2023

7:07 PM