- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

- When you entered the 1099-Q in Federal, you should have entered the distribution, interest, and basis. Go back and double check that you did.

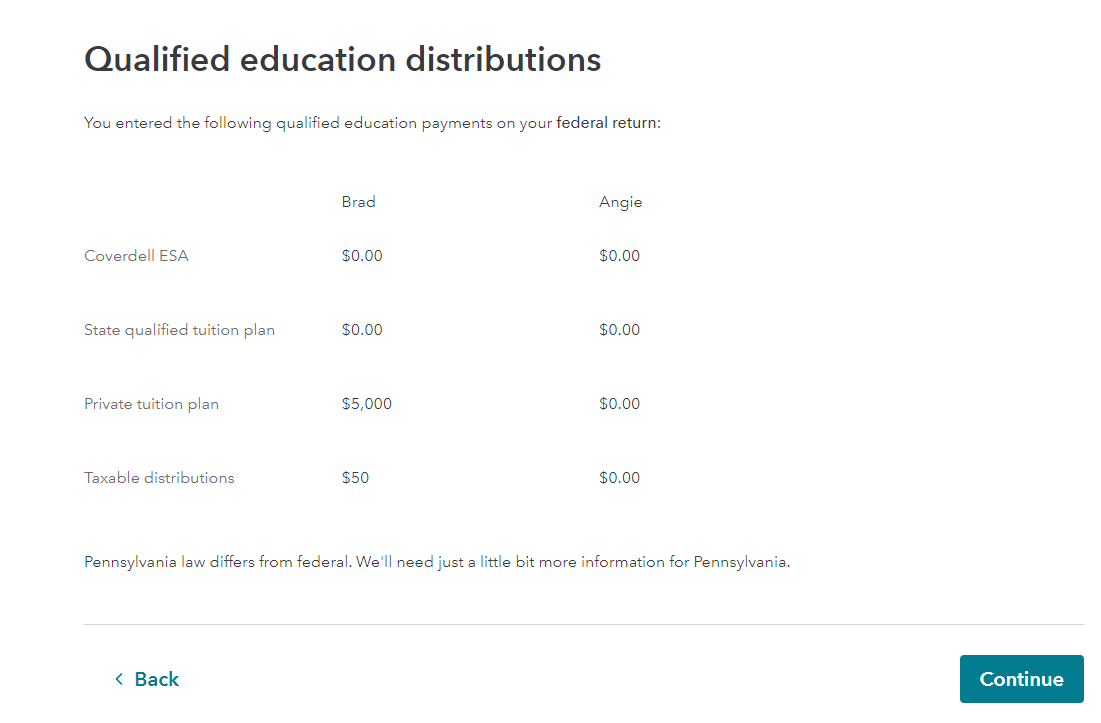

- Next, check in the PA return. As you go through, you will see a screen with an education summary. Check that it is accurate.

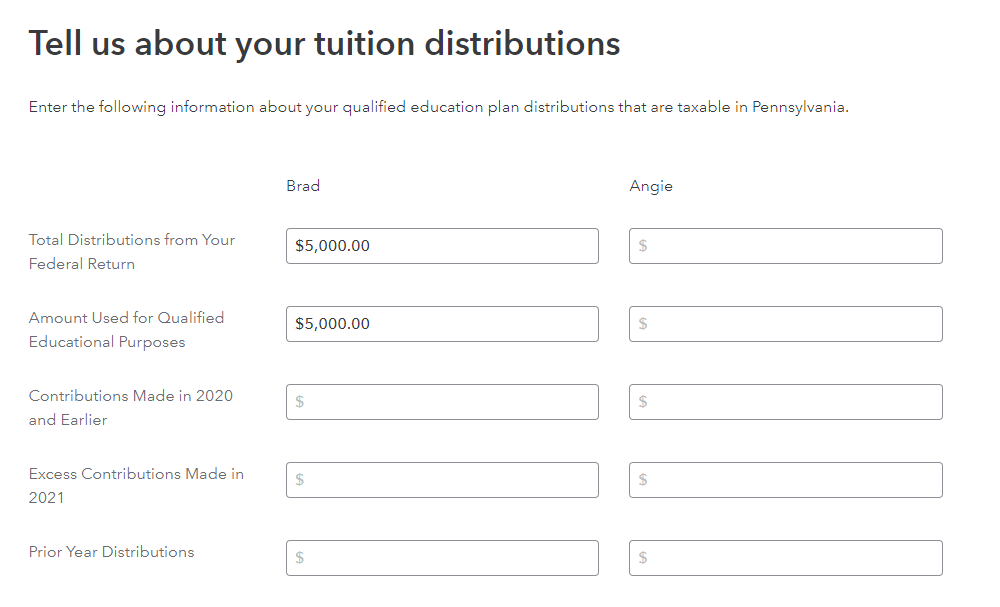

- The next screen allows you to enter qualified distributions, fill it in.

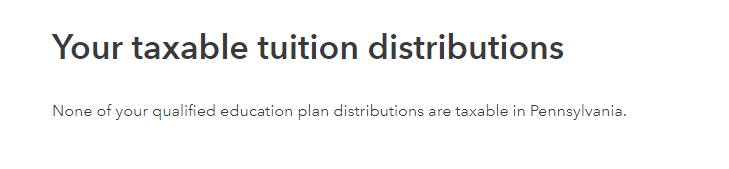

- Then you will see you have no taxable distribution, if that is the case.

Screenshots of PA below:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

December 30, 2021

3:52 PM