- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

It depends.

TurboTax typically utilizes the deduction or credit that yields the highest tax benefit for your particular situation.

You can review the results for your particular case by doing the following:

Go back into your federal interview section.

- Select Deductions & Credits

- Select Expenses and Scholarships (Form 1098-T)

- Select Continue through the pages until you see Next, We'll See Which Deduction or Credit Will Save You the Most

- Select Maximize Your Tax Break

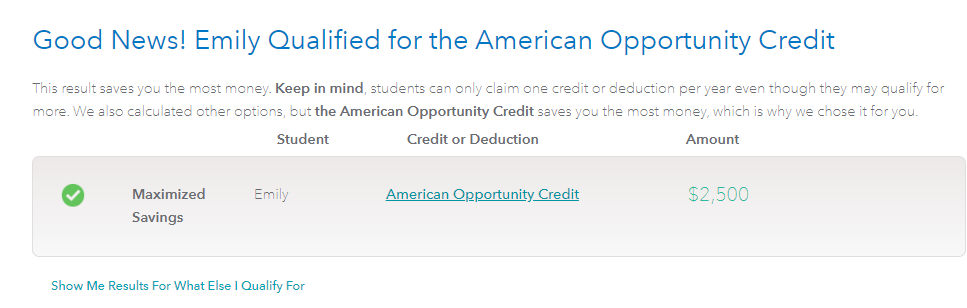

- You will see the following screens showing what you qualify for:

On this page, select Show Me Results For What Else I Qualify For.

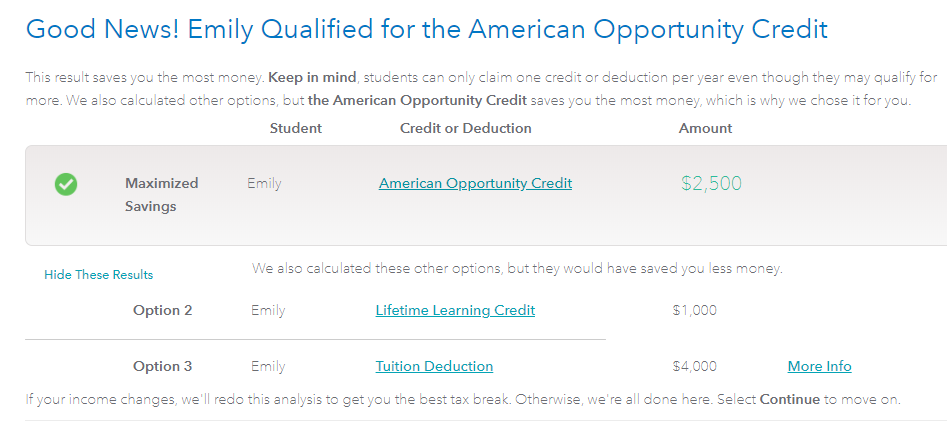

When you do this, you will see the following screen that will tell you the amount of the other credits/deductions available and the amounts you would get if used those options instead.

Select More Info to get more details on how it applies to you.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 11, 2020

12:04 PM