- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Education

You are correct that scholarships can be taxable if they are used for the following items:

- Room & board

- Travel & incidental expenses

- Any fees, books & supplies not required for classes

Scholarships are not taxable if used at an eligible school for a degree if:

- Tuition & fees

- Fees, books, supplies needed for classes

- Scholarship or fellowship for services from:

- National Health Services Corps Scholarship Program

- Armed Forces Health Professions Scholarship & Financial Assistance program

Review your input.

If you received a 1098-T, ensure that the information is entered as follows:

- Go to the Federal section of the program.

- Select "Deductions & Credits"

- Select "Expenses and Scholarships (Form 1098-T)" and click start

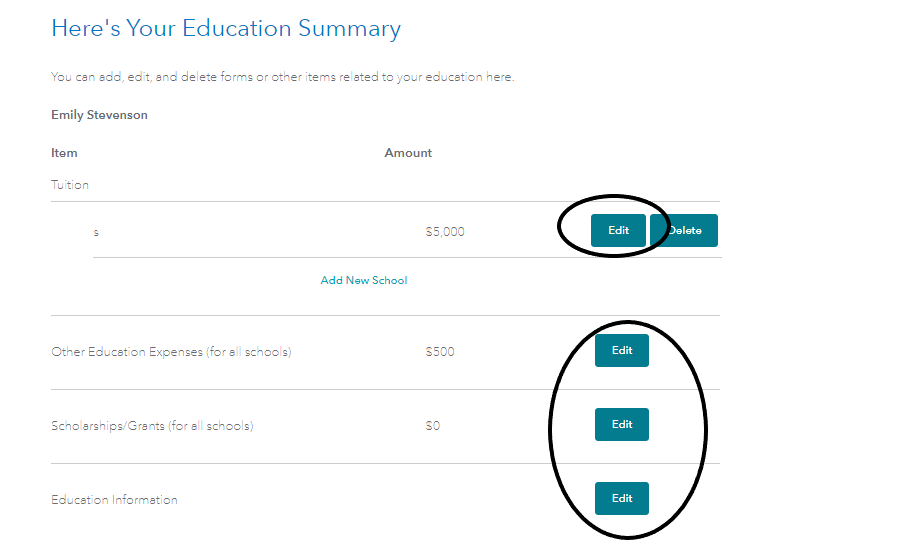

- Select "Edit" to review your input.

Once you review the above, you can also review each section on the following page to ensure you have entered all applicable expenses.

Be aware, it is possible your tuition was paid at the end of 2018 and picked up on your 2018 Form 1098-T. If this is the case, your scholarship income may very well be taxable as you have already taken the tuition deduction in the prior year.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 8, 2020

6:05 PM

553 Views