- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

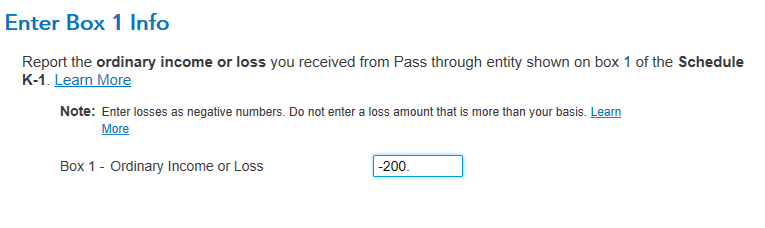

A loss reported in box 1 of the K-1 (1065) may be used to offset W-2 income but the loss must pass the three limitations standards.

The three limitations are:

- Basis limitation,

- At-risk limits (Form 6198), and

- Passive limits (Form 8582)

In the TurboTax software the limitations are addressed at different screens.

Basis limitation

Click Learn more which states:

Basis

Basis is your cost in the investment. It includes the purchase price of the initial investment (plus commissions and other purchase expenses), plus or minus any basis adjustments that occur while you own your interest in the investment.

Your basis may equal your initial investment, but often it does not. You cannot deduct a loss on an investment that is greater than your tax "basis".

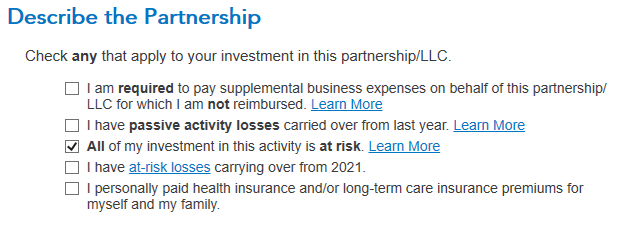

At-risk limits (Form 6198)

Click Learn more which states:

At-Risk Rules

The at-risk rules prevent you from claiming losses that exceed your actual investment in a business. Your loss is considered the lesser of the following:

- The amount of the loss

- The amount you have at risk in the activity

You are at risk up to the amount of cash and the adjusted basis of other property you contribute to the activity. Funds borrowed for use in your business and for which you are personally responsible can be added to the at-risk amount..

You are not considered to be at risk if you:

- Do not have to repay borrowed amounts because you have an arrangement that protects you from loss.

- Borrowed money from a lender who has an interest in the business other than as a creditor.

You can carry disallowed losses forward to a year when you have amounts at risk. Be sure to keep records of these disallowed losses so you can claim them in later years.

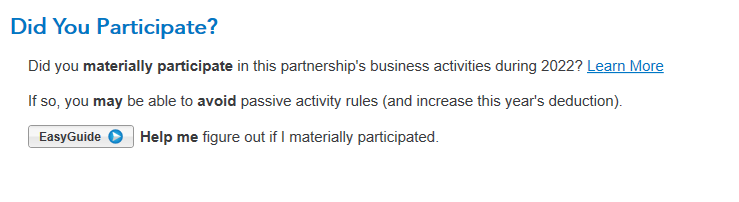

Passive limits (Form 8582)

Click the EasyGuide to determine whether you materially participated.

Section 199A refers to the Qualified Business Income Deduction. This IRS FAQ states:

Many individuals, including owners of businesses operated through sole proprietorships, partnerships, S corporations, trusts and estates may be eligible for a qualified business income deduction, also called the section 199A deduction. Some trusts and estates may also claim the deduction directly.

The deduction allows them to deduct up to 20 percent of their qualified business income (QBI), plus 20 percent of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"