- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

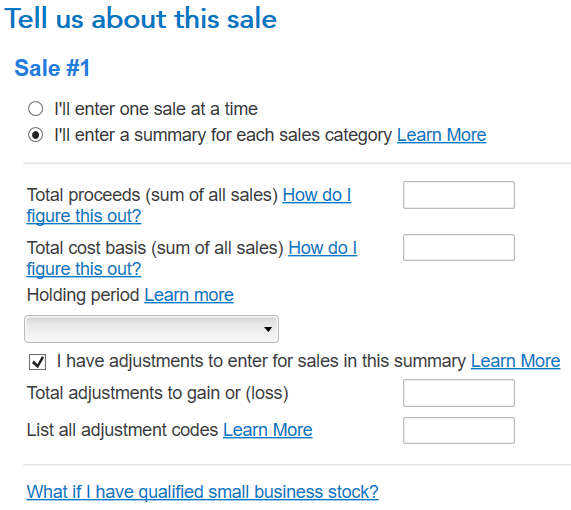

I do not see the "Select any less common adjustments that apply" screen when adding/editing sales in the item automatically created for the 1099-K. As I mentioned up front, I am using TurboTax Deluxe desktop. This is what it shows (I chose the "enter a summary for each sales category" option because no adjustment at all can be made in the "enter one sale at a time" option):

How do I get to the "Select any less common adjustments that apply" screen you showed?

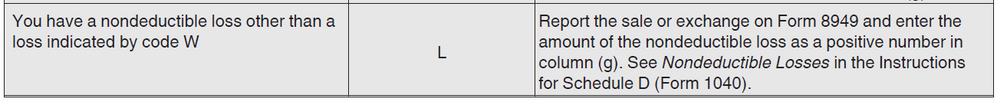

Also, upon further review, the adjustment code "L" may not be applicable to a personal item sale. Here is the description from page 9 of "2022 Instructions for Form 8949":

The referenced section "Nondeductible Losses in the Instructions for Schedule D (Form 1040)" on page D-4 states:

"Don't deduct a loss from a sale or ex-change between certain related parties."

But this is not applicable to a sale of used personal items to an unrelated party on eBay. Hence, the adjustment code "L" may not be the right one, and all other codes in the table seem to be even less applicable. So which code should a TurboTax user enter in this reporting situation?