- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

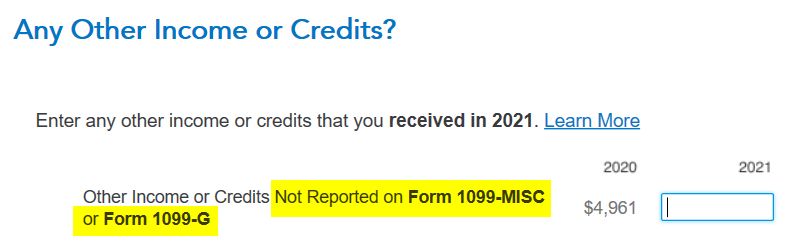

While I do very much appreciate it, the suggestion to report the 1099-G income within the Schedule F under "Other Farm Income" doesn't appear to be allowed by the TurboTax design and/or the IRS. The screenshot below indicates that in this box, you are only to report other income that is "not reported on...Form 1099-G". Are you suggesting to simply ignore this requirement, and enter it anyway? If I follow this suggestion, the amount gets reported on Line 43 (we use accrual method of accounting) where it states explicitly: "Enter income (not reported on 1099)". It doesn't seem right to me to enter the grant income here, because it WAS reported on 1099.

Related, I note on the Schedule F itself that another sub-line below and part of Line 43 is "From Forms 1099-G". This seems like a good place to put the income, but the only way I can make the grant amount appear on this line is to enter it (in contradiction to what the 1099-G says) as Box 2/Box 8 "trade or business income". Another option, and yet another fairly unsatisfying solution. The 1099-G she received indicates Box 6 Taxable Grant. Forcing TurboTax to enter this as Box 7 or Box 8 income is not right.