- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You must report all your income, whether or not you get a reporting form. Double-check your records to make sure this is accurate and you are not double-counting income.

Speak to the merchant and ask why you did not get a 1099-K for this income.

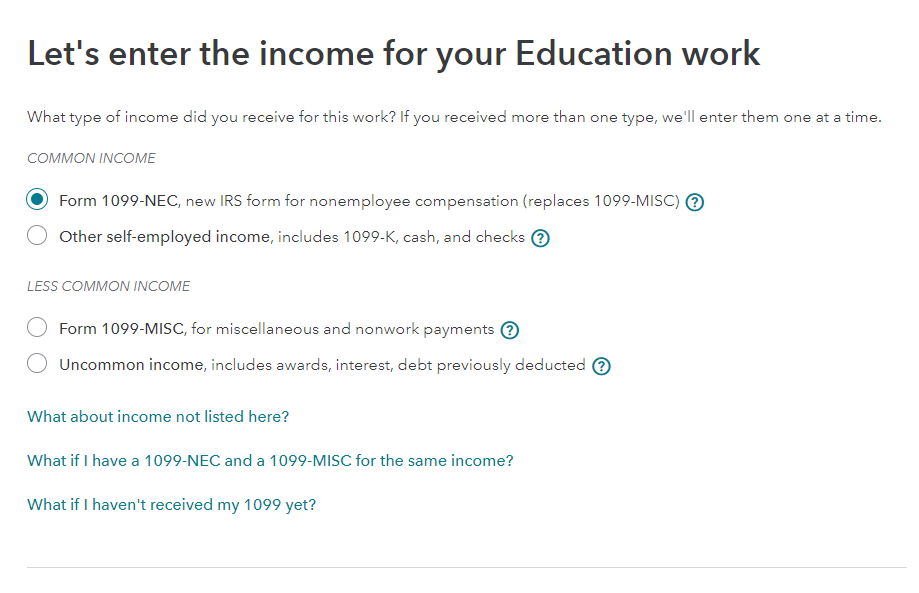

You can report it as non 1099-NEC income, with the notation of ACH transactions. If you are using the Self-Employed version, the second option in this screenshot is cash.

March 8, 2022

6:36 AM